How to reconcile company and personal accounts in AgExpert Analyst

What happens when you use the corporate card for a personal expense? Or you use your personal card to purchase for your business? Here’s how to set up and reconcile your accounts, whether you’re a Sole Proprietor, Partnership or Corporation.

If you’re a Sole Proprietorship or Partnership

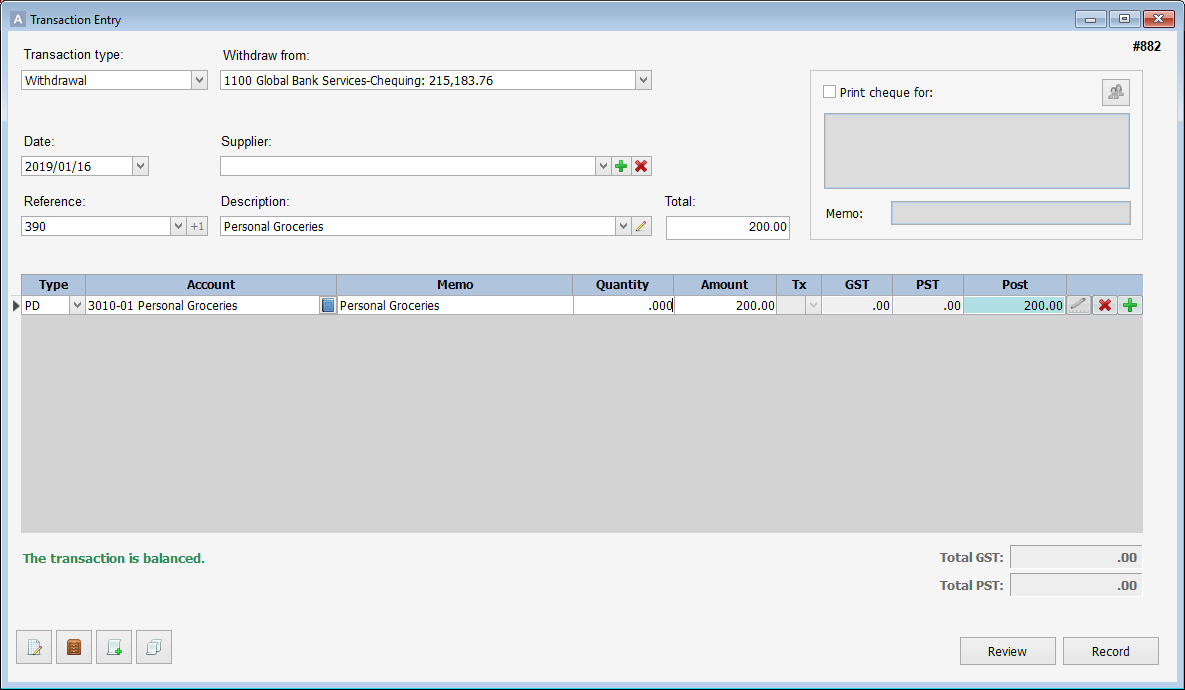

Using business funds for a personal purchase? That’s recorded as Personal Drawings, which are listed under the Equity tab in your Chart of Accounts. For example: using the company credit card to purchase groceries.

Your personal funds deposited into the business account or spent on business items are recorded as personal advances, listed under the Equity tab in your Chart of Accounts. For example: a personal deposit to the farm chequing account. Personal funds are used for business purchases.

If you’re a Partnership or Sole Proprietor and don’t have Personal Drawings or Personal Advance accounts, follow these steps:

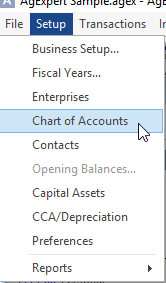

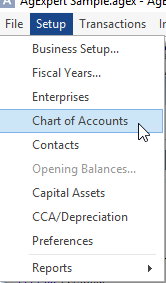

- Go to the Setup menu and Chart of Accounts.

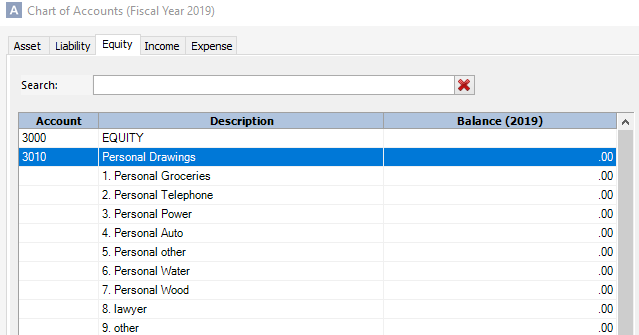

- Click on the Equity tab.

- Find a number that’s not already in use and click Add.

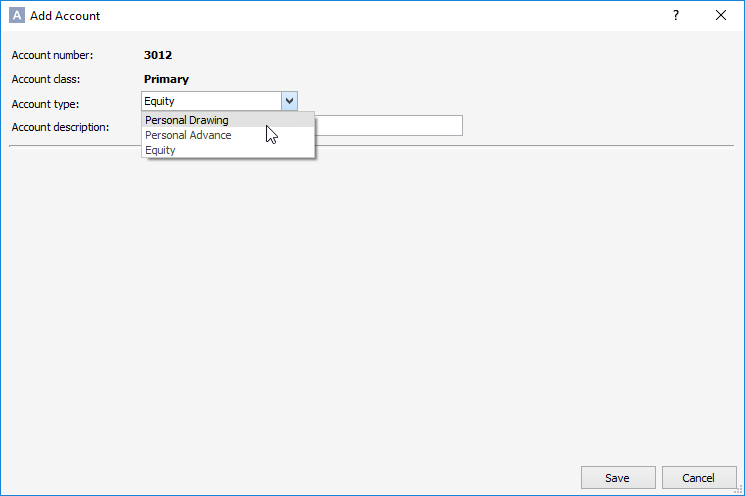

- You’ll want to add a primary account first and select the account type Personal Drawing. The account description should also be Personal Drawing.

- You can now add sub accounts under the Personal Drawings account. Select Personal Drawings and click Add.

- Repeat steps 1 through 5 for Personal Advance accounts.

If you’re a Corporation

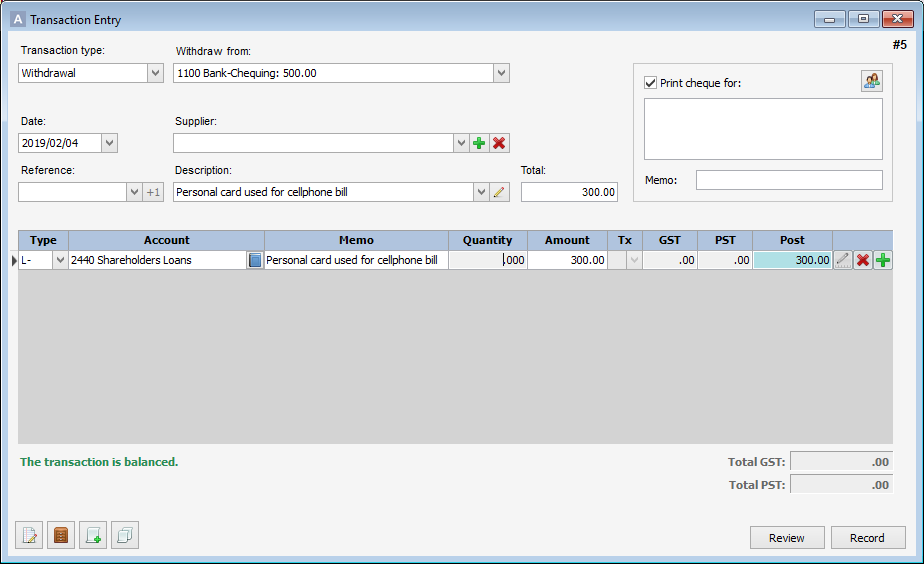

Business funds you take out or spend on personal items are recorded as shareholder drawings. This account is located under the Liability tab in your chart of accounts. You could also post to a loan payment (L- line) in the appropriate shareholder’s loan account. For example: using a company card to pay for your kids’ cellphone bills.

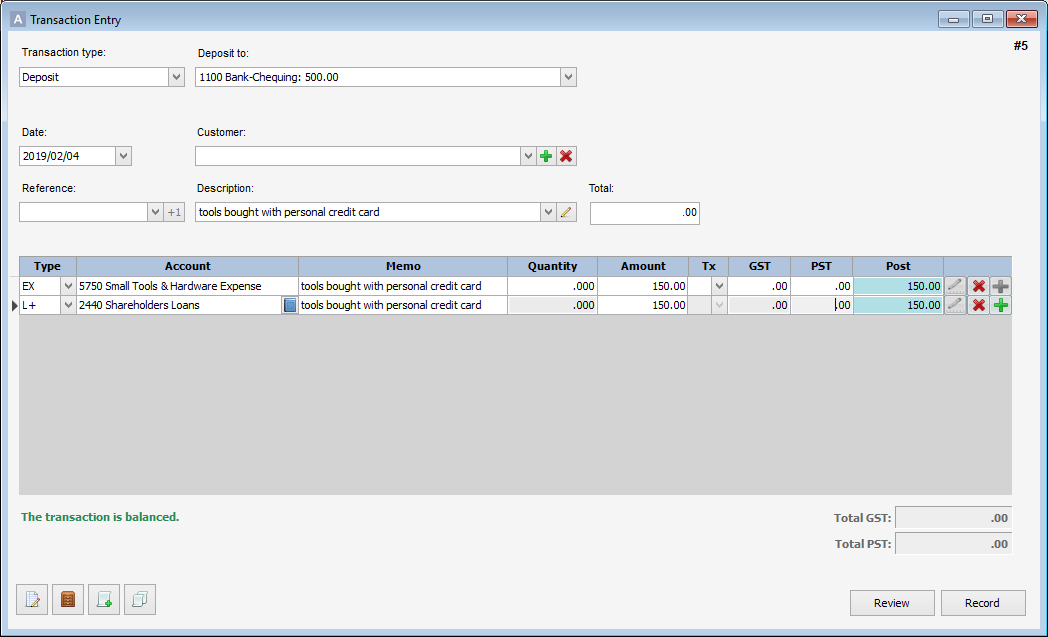

Personal funds you spend on business items or deposit into the business account are posted as a loan addition (L+ line) to the shareholder’s loan account. This account is in the liability section of your chart of accounts. For example: buying tools for your business on your personal credit card.

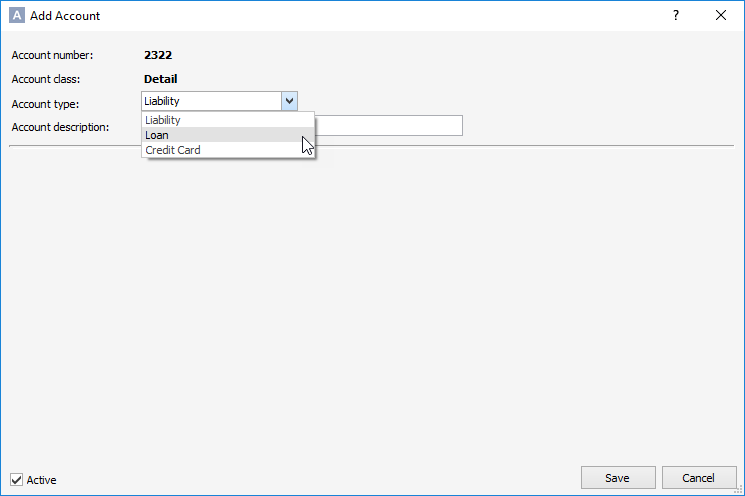

If you’re a Corporation and don’t have a shareholder’s loan account, follow these steps:

- Go to the Setup menu and Chart of Accounts.

- Go to the Liability tab.

- Find a number that’s not already in use, click Add.

- The account class will be Detail. Click on Create Account. Choose Loan as the Account type, add the description (Shareholder’s loan) and save.

Friday, February 15, 2019 at 2:45PM

Friday, February 15, 2019 at 2:45PM

Reader Comments