Transactions > Transactions examples - Income > Cash Sales and Rounding

Looking for something specific in the page and not quite sure where to find it? You can always press CTRL + F on your keyboard and type a keyword. Or you can do a search (in the top right corner).

Cash Sales and Rounding

Since the abolishment of the penny, all cash sales are now being rounded to the nearest five cents. If you take in any sales in cash, you will need to be able to make this adjustment in your deposits so that your accounts receivable show the correct balances.

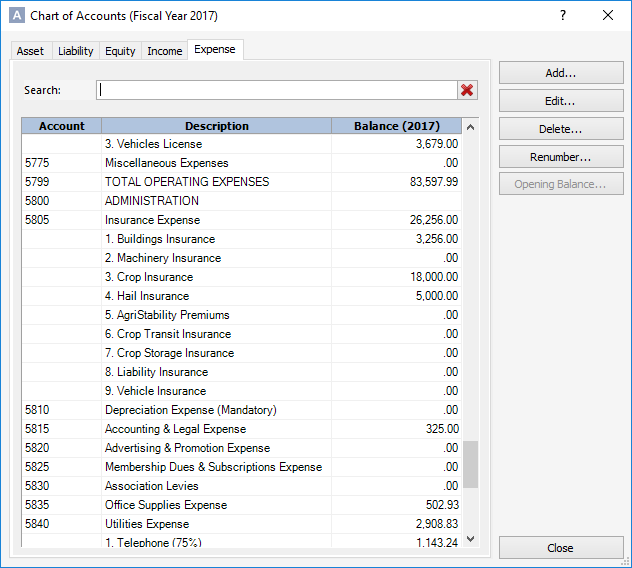

Start by going to Setup > Chart of Accounts. Click on the expense tab. Scroll down to your section for Administration if you have it.

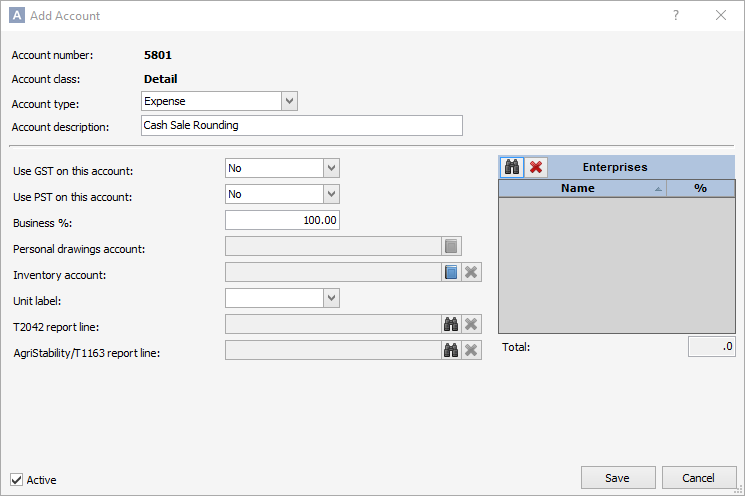

Find an account number that is not currently in use. Click on Add. Add an account in the Administration section called Cash Sale Rounding (or something similar to this).

Now that this account exists in the chart of accounts, you can use it to account for any rounding you have to do when accepting cash from your customers. This will apply to any cash received, whether it is for a sale in the moment, or a received on account item.

When determining your rounding, the general rule is to round to the nearest 0.05. For example, 0.21 and 0.22 will round to 0.20. 0.23 and 0.24 will round to 0.25. 0.26 and 0.27 will round to 0.25. And, 0.28 and 0.29 will round to 0.30.

In your transaction entry screen, you can use this expense account to balance your transaction as necessary for the one or two cents required. The amount on this line should never exceed 0.02 or -0.02.

Last updated on November 21, 2019 by FCC AgExpert