Taxes > GST/HST > Recording a GST/HST Payment or Refund

Recording a GST/HST Payment or Refund

After your GST/HST return has been processed, the payment or refund amount must be entered as a transaction.

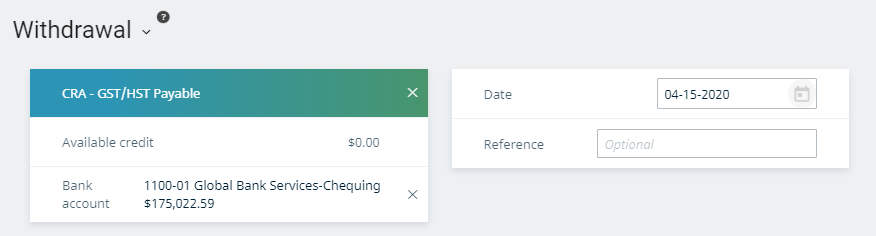

To enter a GST payment, click the Quick Action Menu and click Withdrawal.

Select CRA – GST/HST Payable as your supplier, the bank account the payment came from, and the date that the payment was made. You may also enter any reference you would like (such as a cheque number).

Select Payable Payment (PP) as your type. In Detail, select the GST/HST return you are making a payment on. The Total will automatically fill in as the full amount of the invoice. You can change this number if it is not the same as listed.

If your total is the same amount as the payment you made, you can click Save.

To enter a GST refund, click on the Quick Action Menu and click Deposit.

Select CRA – GST/HST Receivable as your customer, the bank account the refund is being deposited to, and the date that the refund was received. You may also enter any reference you would like (such as a deposit number).

Select Receivable Payment (RP) as your type. In the Detail, select the GST/HST return you are receiving. The Total will automatically fill in as the full amount of the invoice. You can change this number if it is not the same as listed.

If your total is the same amount as the refund you received, you can click Save.

Last updated on November 18, 2019 by FCC AgExpert