Thursday

May302019

Six ways to file your GST return made simple

Let’s simplify all the ways to file your GST/HST return. There are numerous ways to get this done, but it’s up to you to decide which way works best for you and your business.

First, you’ll need a registered GST/HST account. If you don’t have one, you can simply register online.

Here are six ways to file your return:

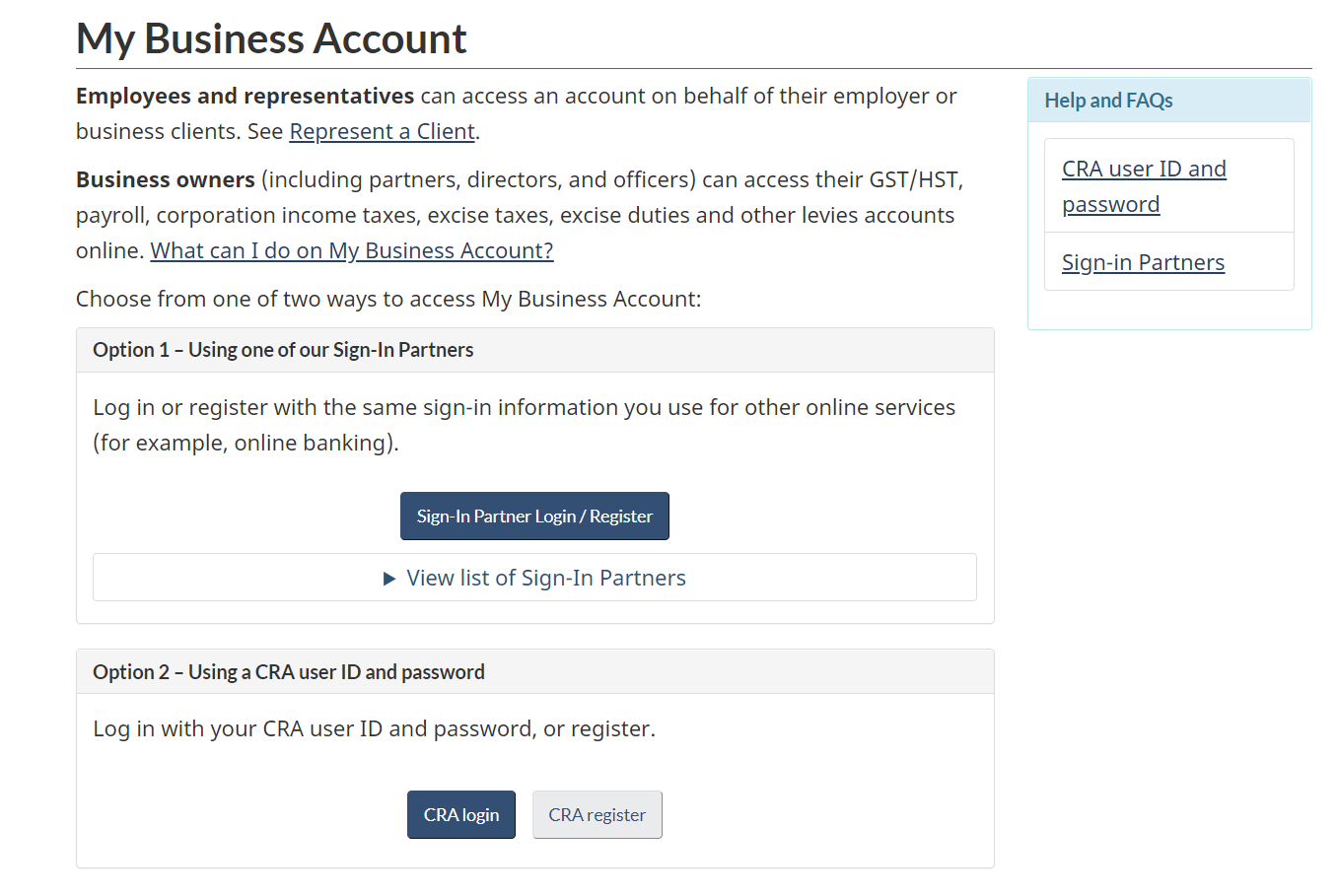

- My Business Account

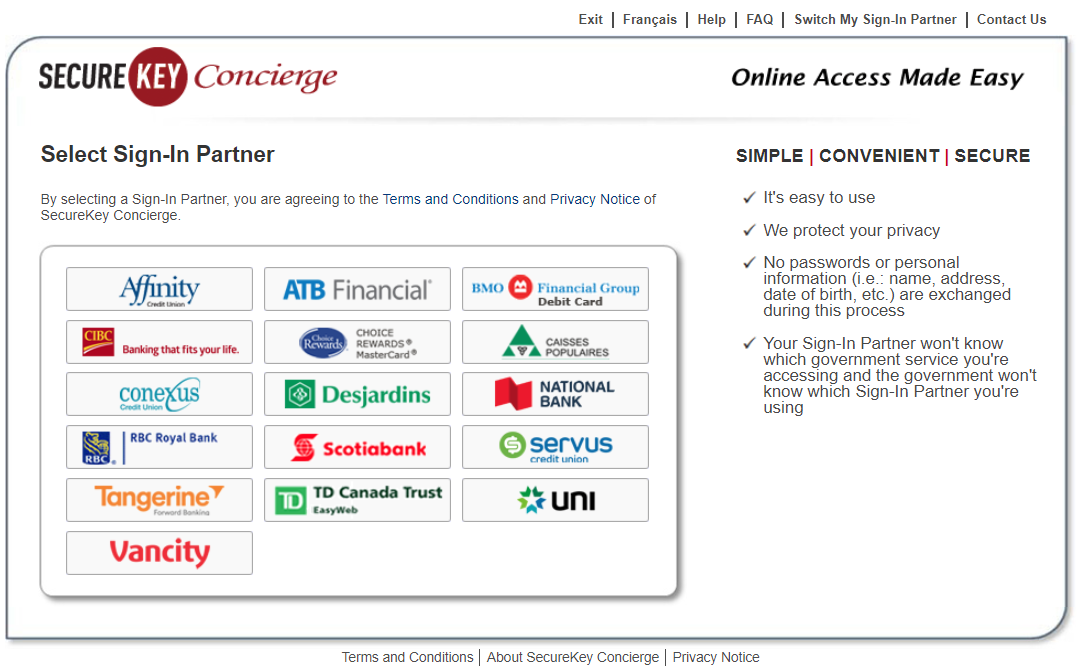

Register or sign in to My Business Account. Use the sign-in partner or your CRA user ID and password. The sign-in partner does not require a CRA user ID or password.

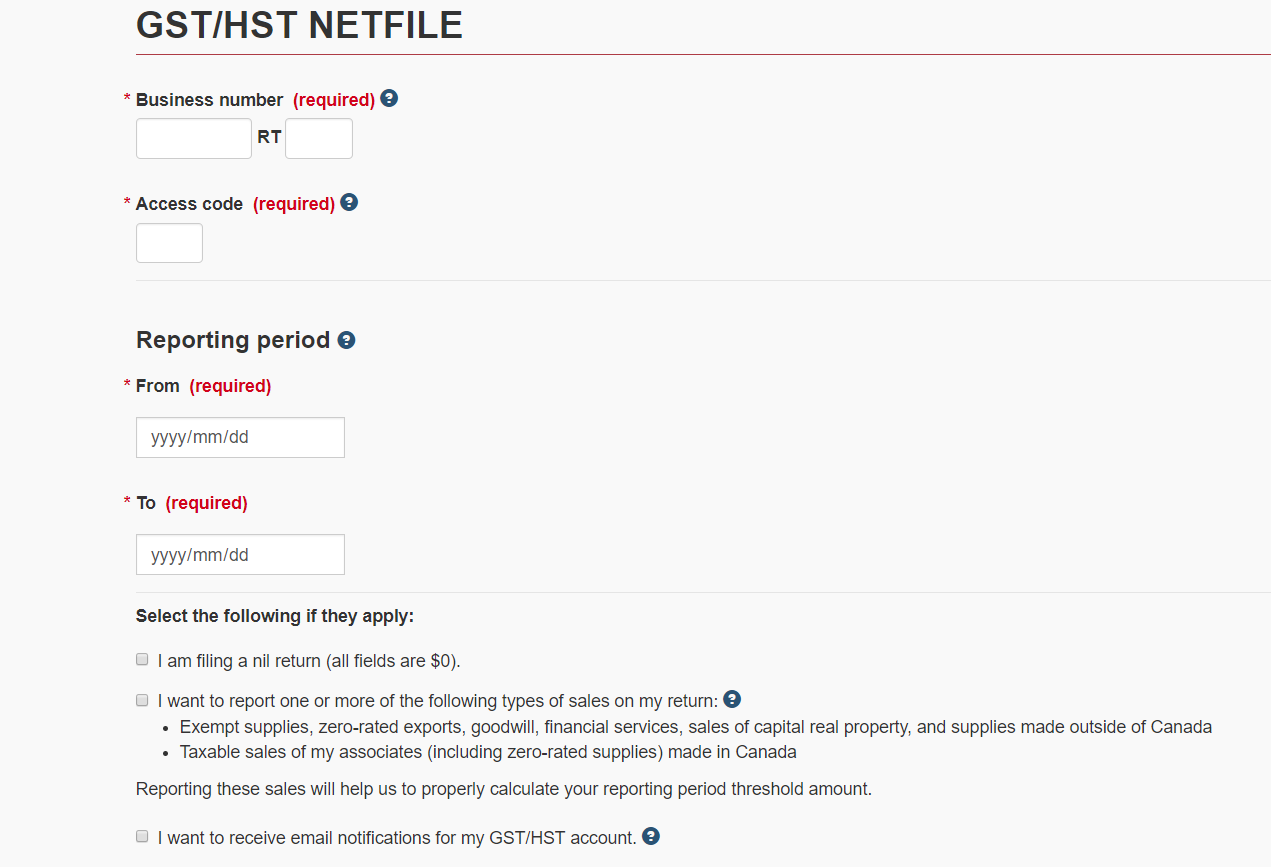

- Netfile

AgExpert Accounting software makes using GST/HST Netfile even simpler by creating your GST or HST report. Once you’ve created your report in AgExpert, click Submit Netfile.From the Netfile page, click on Ready to file. This will bring you to a screen with a short explanation of what to do. Select Continue to begin your return.

- Electronic Data Interchange (EDI)

Filing your GST/HST using an EDI allows you to transfer your return information to a participating Canadian financial institution. They will convert the information into an electronic return and send it to CRA. If there is an amount owed to you it will be deposited directly into your account. If there is an amount owed, it can be paid through the same financial institution. - GST/HST Telefile

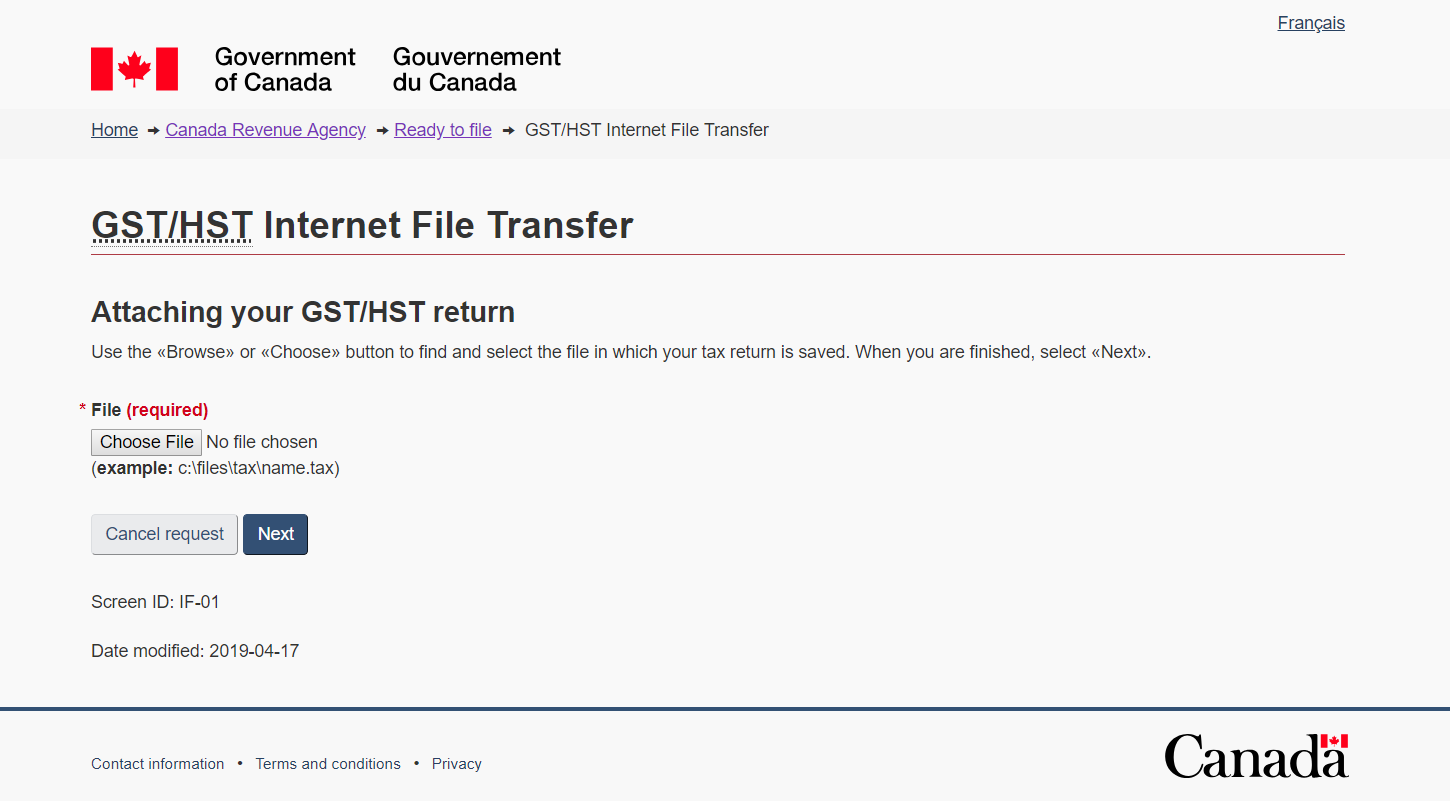

The GST/HST Telefile is a fast and free method of filing your GST/HST return. CRA recommends four steps before you use Telefile. When you're ready, call 1-800-959-2038 and follow the instructions. Once you have completed the Telefile you will be given a 6-digit confirmation number. - GST/HST Internet File Transfer

The internet file transfer allows you to file your GST/HST return directly to CRA using an accounting software. Click Ready to file, then read through the information and click Continue. This brings you to a page where you can attach your file.

- Paper filing

If you are not required to electronically file your GST/HST return, you may be eligible to file a paper return by mail or in-person at a participating financial institution. Not all returns can be filed in-person at a participating financial institution. If you are claiming a return, filing a return of zero, or if you are offsetting the amount owing with a rebate or refund, you cannot file your return in-person.

Posted on  Thursday, May 30, 2019 at 12:54PM

Thursday, May 30, 2019 at 12:54PM

Thursday, May 30, 2019 at 12:54PM

Thursday, May 30, 2019 at 12:54PM

Reader Comments