Before you issue T4s: make payroll changes using AgExpert Accounting

Published Jan 11, 2022

If you’re an employer and pay your employees (income, commissions, taxable allowances and benefits, retirement allowances, etc.), it’s time to prepare to file T4s and summary reports with Canada Revenue Agency.

Why is this so important? If you’re out in your payroll remittance at the end of the year, you might receive a PIER (Pensionable and Insurable Earnings Review). Interest and penalty fees may apply too. Use AgExpert Accounting to save the hassle and prepare your T4 summary balances before year-end filing.

Here are a few quick tips:

- · Balance one T4 slip at a time

- · Make sure you’re using current CPP and EI rates found on the CRA website

- · Submit your T4 summary to the CRA together with the related T4 slips, on or before the last day of February; do this before saving the balancing remittance

- · Print copies of each T4 slip for all your employees

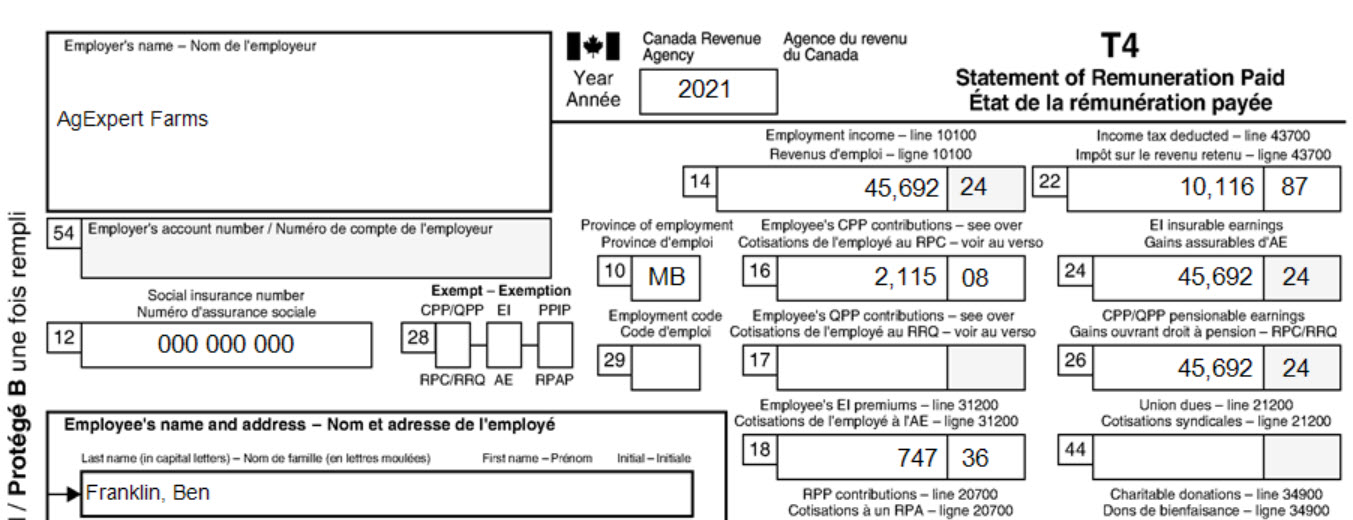

Here’s an example

Start with Box 16 containing employee’s CPP contributions and determine if the amount is correct.

Let’s say your employee makes a gross salary of $45,692.24 (Box 14). For 2021, the amount in Box 16 should be $2,299.48 ($45,692.24 - $3,500.00) = $42,192.24 x 5.45%. We’ve only deducted $2,115.08 in this T4. We need to increase our CPP deductions by $184.40.

To adjust the CPP amount, create a new paycheque with no other deductions and offset this by entering the opposite amount into the Federal Tax field.

Set both the pay date and the period end date to December 31, 2021 when creating the adjusting paycheque.

Now let’s look at Box 18: confirm total EI deductions

The 2021 EI rate is 1.58%. The correct EI to be deducted should be $721.94 ($45,692.24 x 1.58%), but we’ve deducted $747.36. Make an adjustment by creating a new paycheque to reduce the EI amount by $25.42 and offset the opposite amount into the Federal Tax field.

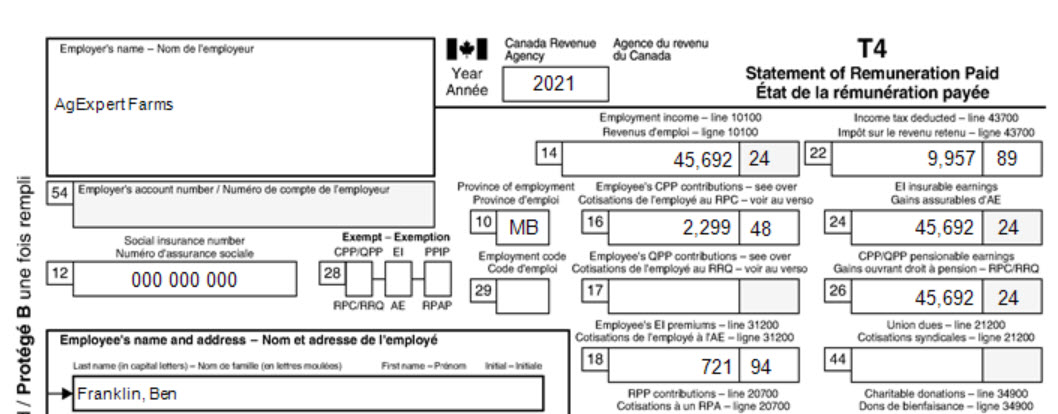

The adjusted T4 slip should now have correct CPP and EI amounts in boxes 16 and 18.

When your employee slips are balanced, you can submit your return to CRA.

Learn more about balancing your T4 report with AgExpert Accounting and AgExpert Analyst.

Visit the CRA website for more about preparing your year-end.

Thursday, January 6, 2022 at 5:19PM

Thursday, January 6, 2022 at 5:19PM