Make your financial statements crystal clear with AgExpert Accounting

Published March 7, 2022

Even if you didn’t take that accounting class, you can still make sense of your financial statements. And when you can interpret your reports and statements, you become a more effective business manager. Trust AgExpert Accounting to make understanding your statements easier.

What are financial statements anyways?

Financial statements are reports that summarize important financial information about your business.

There are various levels of depth, but here are the three main ones:

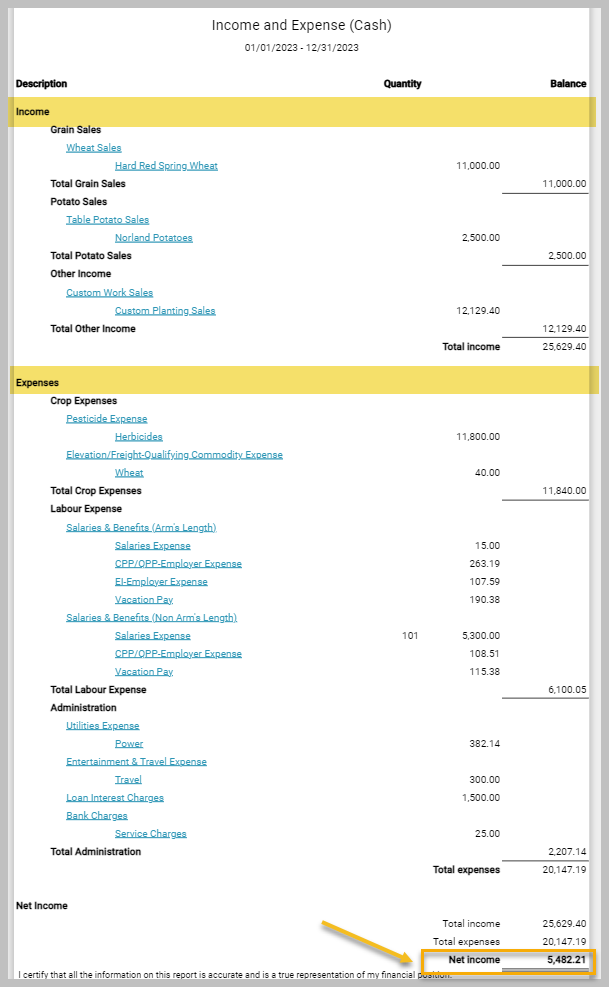

- The Income and Expense Statement, also known as the Profit and Loss Statement. When you run a business, this is arguably your most important report.

- The Balance Sheet.

- The Cash flow Statement. (We’ll talk about this one in a future blog.)

What do financial statements do?

Let’s see how your Income Statement and the Balance Sheet work together to give you a great picture of your company’s performance.

The Income Statement tells you how much money you’ve made during the period, and how much you’ve spent to make that money. Here are some useful Income Statement terms:

- Gross Profit = Revenue - Cost of Goods Sales (COGS)

- Operating profit = Earnings Before Interest & Tax (EBIT) = Sales - COGS - Operating expenses

- Net Profit = Revenue - All expenses

Once those numbers are available, your management team can produce different ratios for a better analysis, such as:

- the Gross Profit Margin = (Gross Profit /Sales) x 100

- the Operating Profit Margin = (Operating Profit/Sales) x 100

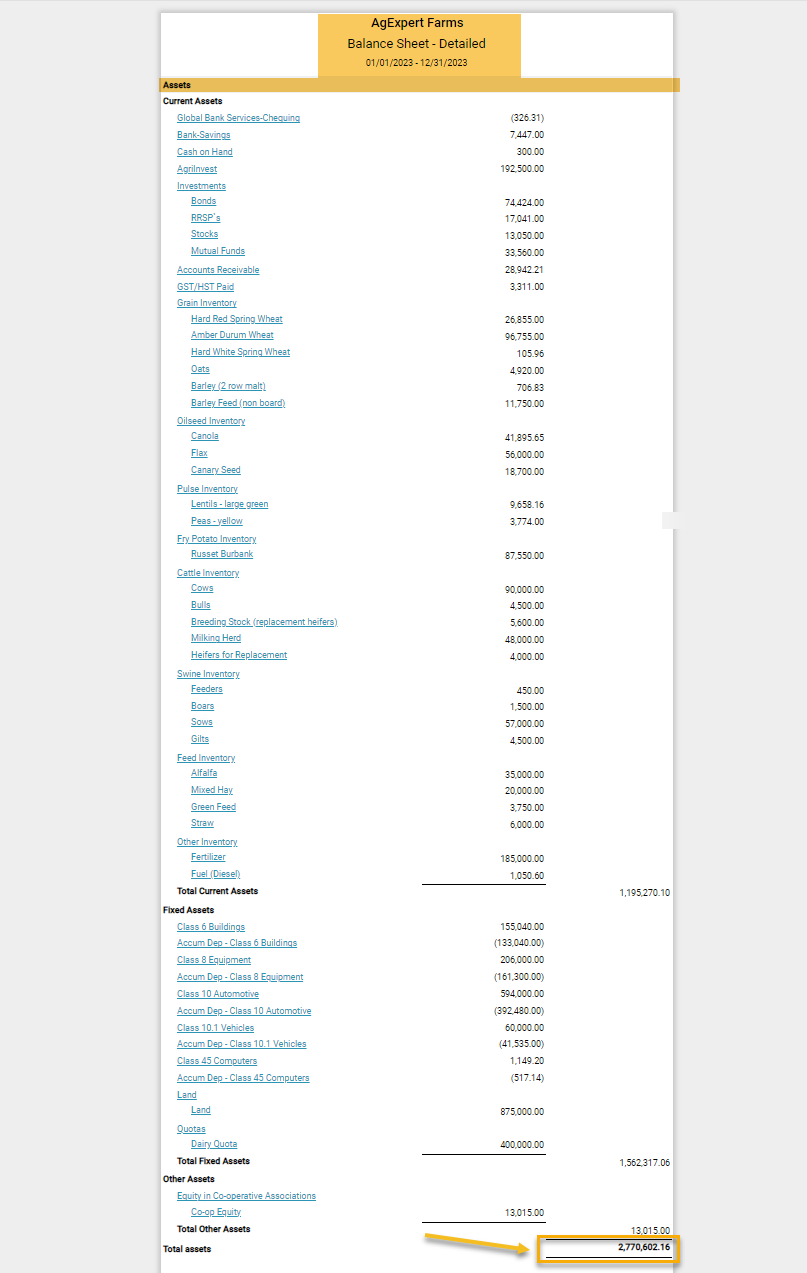

The Balance Sheet shows you where your company’s money came from, where it went, and where it currently is. It’s a snapshot of your business finances at a given date. The three general categories are:

1) Assets tell you about anything that your business owns including funds in your bank accounts, cash, office furniture, inventory, equipment, vehicles, etc. These are usually broken down into Current and Fixed assets.

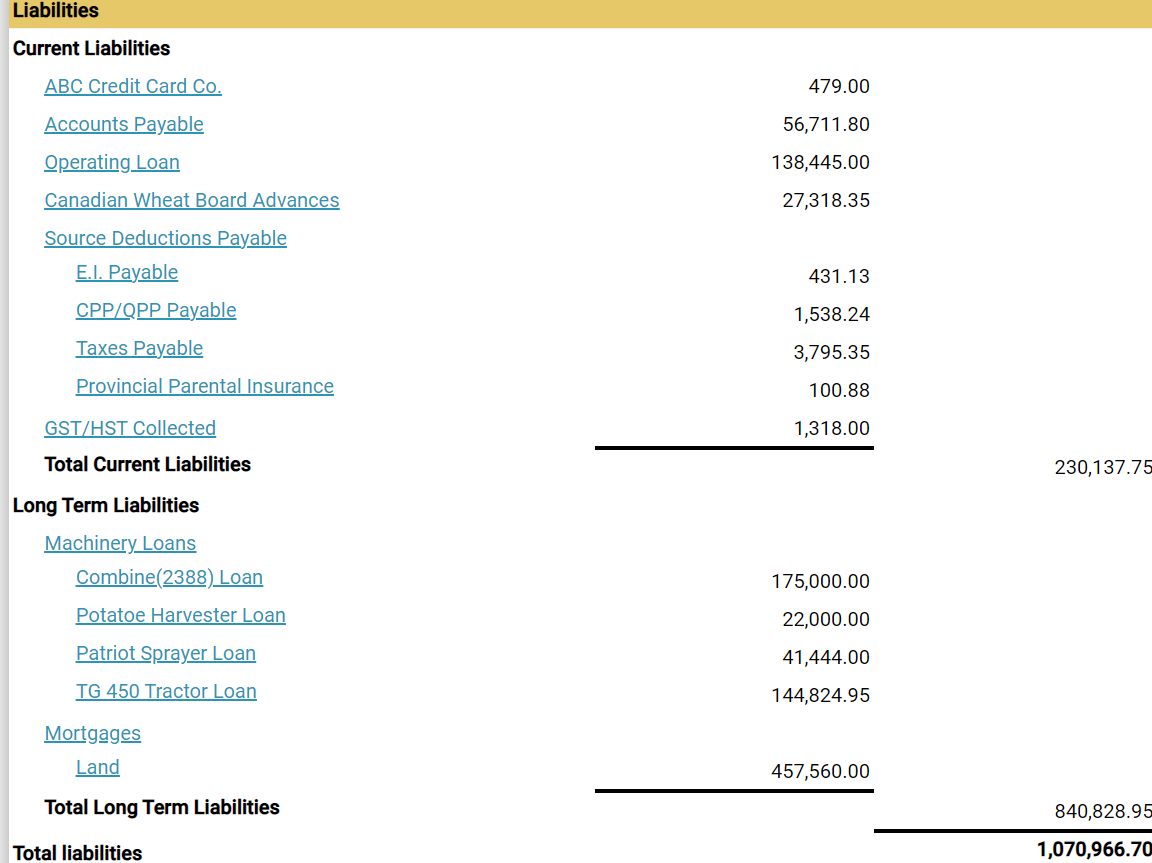

2) Liabilities are debts that you owe to other people at a particular point in time. These can include credit cards debts, accounts payable, operating and machinery loans, etc. Current liabilities are debts to be paid in less than 12 months, whereas long-term liabilities are debts that will last longer.

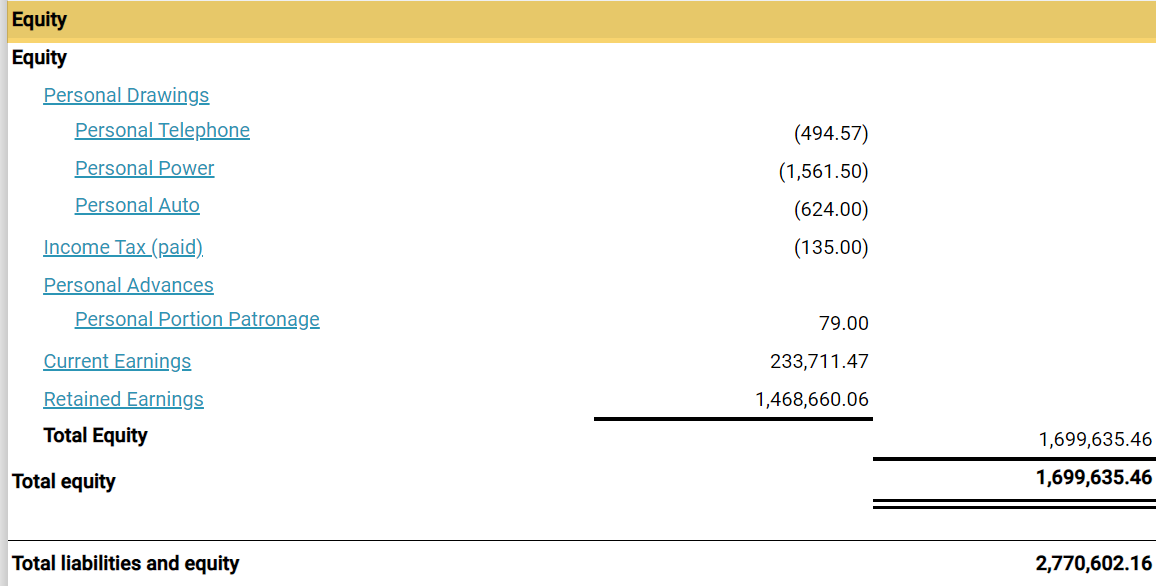

3) Owner’s Equity is the remaining value after subtracting Liabilities from Assets. It can come in the form of common stocks or retained earnings, which is the net income after you’ve paid any dividends to shareholders.

- Assets = Liabilities + Owner’s Equity

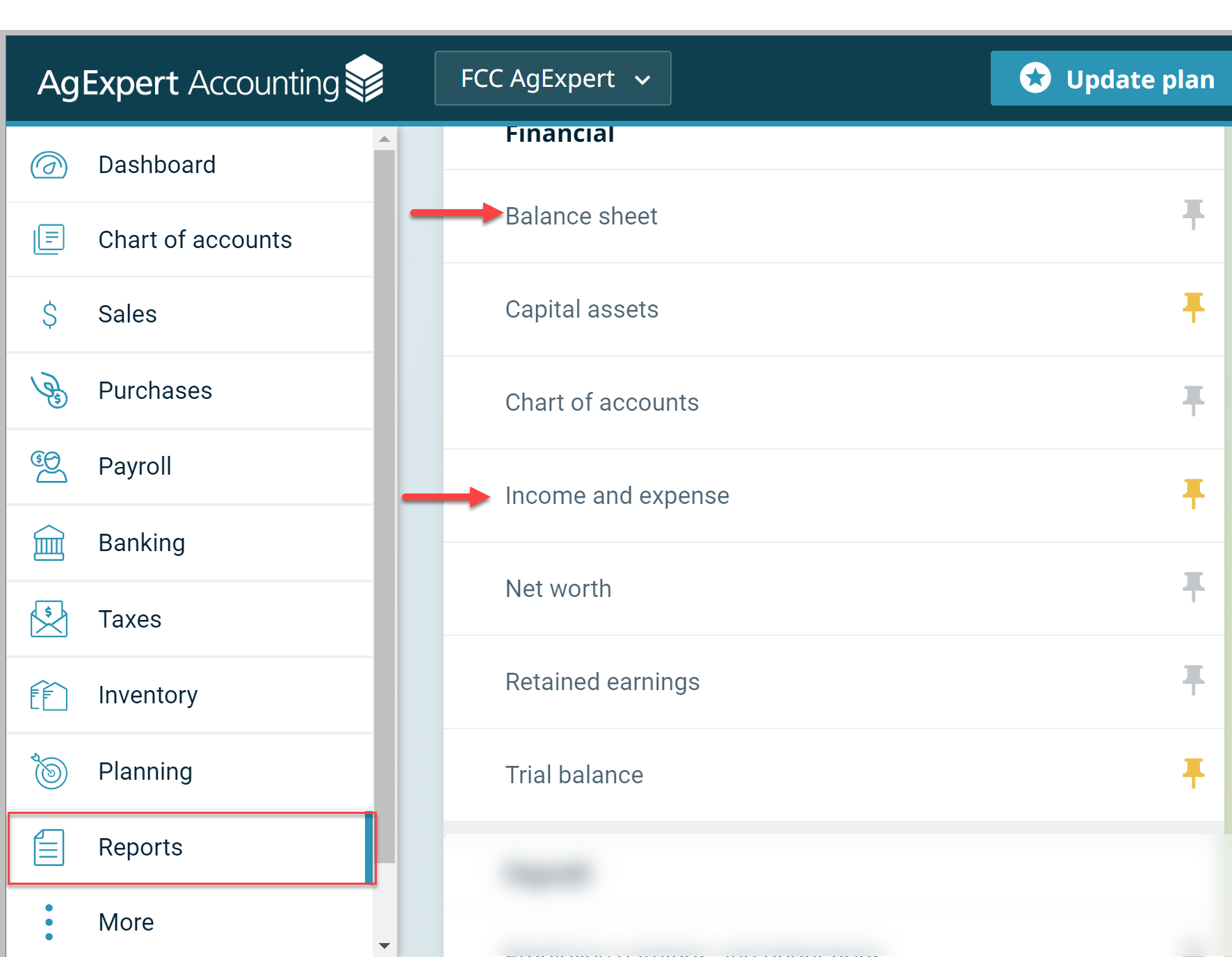

How to generate your reports with AgExpert Accounting

You can easily generate the financial statements required by your accountant, including the Income and Expense Statement and the Balance Sheet Statement, as of the last date of your fiscal year-end. To ensure the numbers reflect your business commitments during the year, run both reports and make corrections if necessary.

Wednesday, March 2, 2022 at 5:11PM

Wednesday, March 2, 2022 at 5:11PM