Payroll > Setup > Setting up Employee Profiles

Setting up Employee Profiles

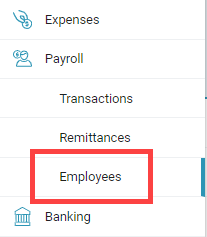

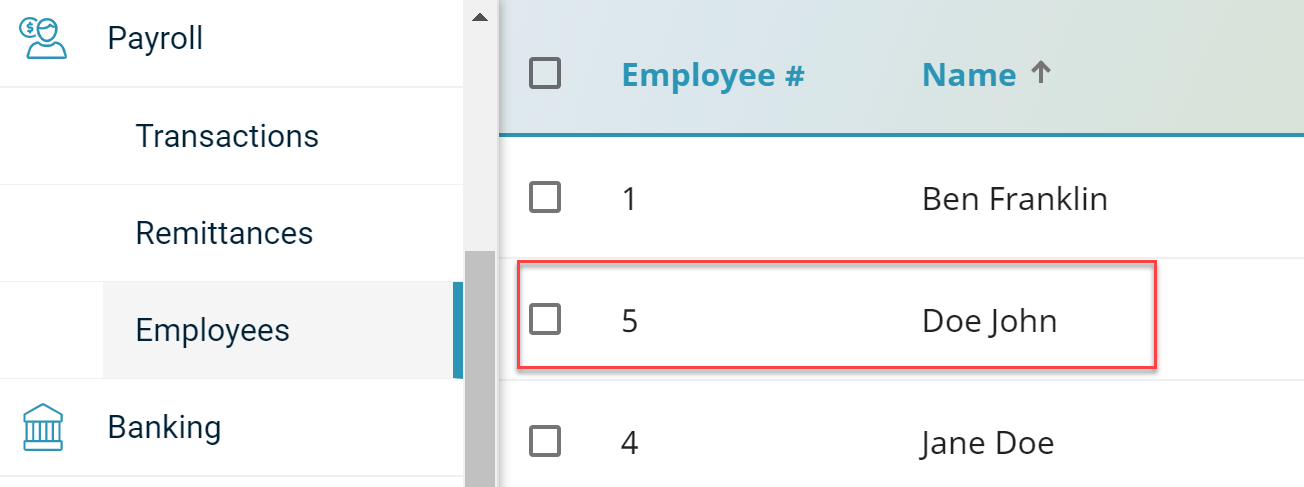

To create a new employee, click Payroll on the left navigation bar, and select Employees.

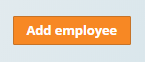

Click Add employee.

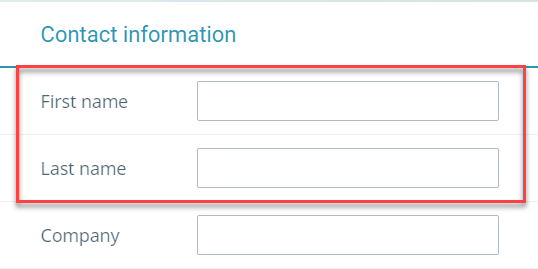

There is a large amount of information to fill out in the employee profile, but you do not need to fill it all out right away. Some information is optional and can be filled out later. It is important, however, to make sure that all information is filled out as soon as possible.

The first and last name of the employee is required.

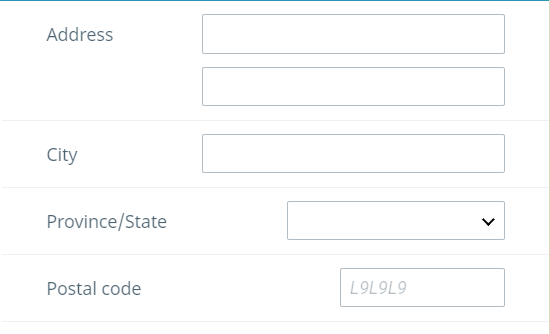

The employee’s address is optional.

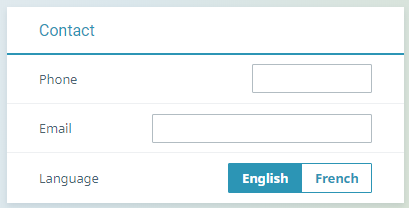

The phone number and email address are optional. A preffered language must be selected.

Employee information is needed for record of employment purposes. To enter the employment information, select Employment.

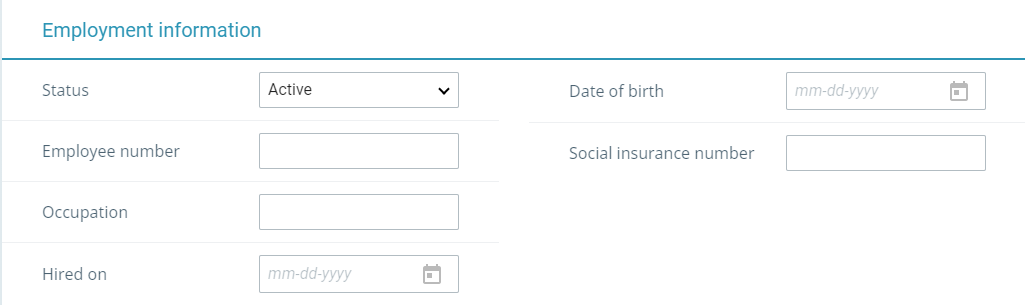

You are required to enter an employee number, the date the employee was hired, the employee’s date of birth and their social insurance number. If the social insurance number is unknown, enter 000000000. The employee’s occupation (or job title) is optional.

Make sure that all required information is filled out:

- Status (required) - select if the employee is active, on leave, or terminated.

- Pay cycle (required) - select how often you pay your employee

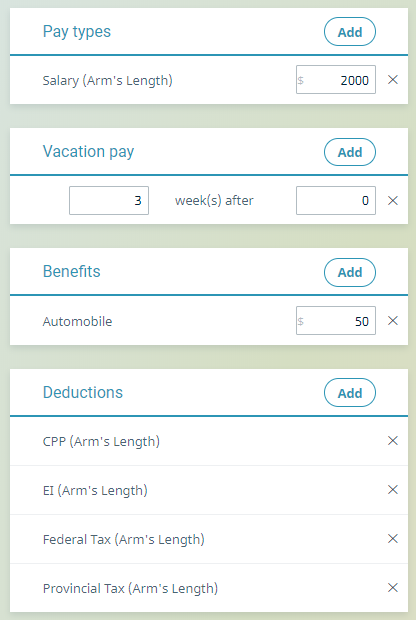

- Vacation pay (required) - select how you want to handle vacation pay. You can choose no vacation, pay out vacation, or retain vacation. You can use the

button to see a history of changes to the field.

button to see a history of changes to the field. - Accrued advances (optional) - if the employee is carrying any outstanding advances, enter them here. You can use the

button to see a history of changes to the field.

button to see a history of changes to the field. - TD1 federal claim amount (optional) - enter the employee's federal claim amount from the TD1 form you received from them. If you need a copy, click the link to download a copy. Please note that this number is important to make sure deductions calculate correctly.

- TD1 provincial claim amount (optional) - enter the employee's provincial claim amount from the TD1 form you received from them. If you need a copy, click the link to download a copy. Please note that this number is important to make sure deductions calculate correctly.

- WCB rate (label will depend on your province of operation) (optional) - if you calculate a WBC remittance, enter the rate for the employee.

- RPP/DPSP registration # (optional) - if you have a pension plan or disability plan for the employee, enter the plan number here.

- Last used RL-1 # (optional) - for users in Quebec only, enter your last used RL-1 number

- RL-1 box 0 source (optional) - for users in Quebec only, enter the source of box 0 for the employee's RL-1 form.

- Employee is at arm's length (required) - toggle on if the employee is at arm's length. Turn the toggle off if they are not.

Finally, enter all applicable pay types, vacation pay, benefits, and deductions. This will include adding any custom items that you require.

Once you are done, click Save.

You can access and edit employee information by coming back to the employee screen and selecting the employee’s name.

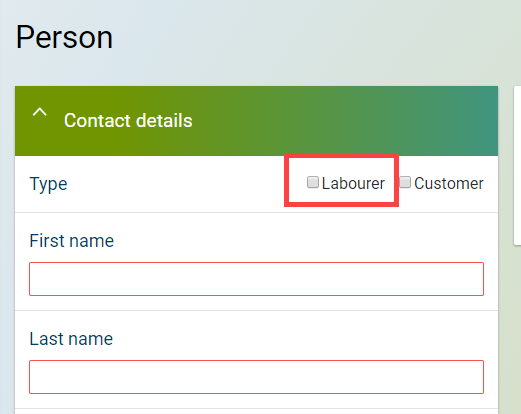

If you are a Field user, anyone you set up in People as a labourer will automatically appear as an employee in Accounting. You will need to fill in their pay information.

Last updated on June 24, 2025 by FCC AgExpert