Transactions > Transaction examples - Specific > Recording a Canadian Canola Growers Association advance

Looking for something specific in the page and not quite sure where to find it? You can always press CTRL + F on your keyboard and type a keyword. Or you can do a search (in the top right corner).

Recording a Canadian Canola Growers Association advance

Canadian Canola Growers Association (CCGA) advances are available to producers in Alberta, British Columbia, Manitoba and Saskatchewan who grow eligible crops. The maximum allowable advance is $400,000. A three per cent withholding is applied to all advances of all amounts.

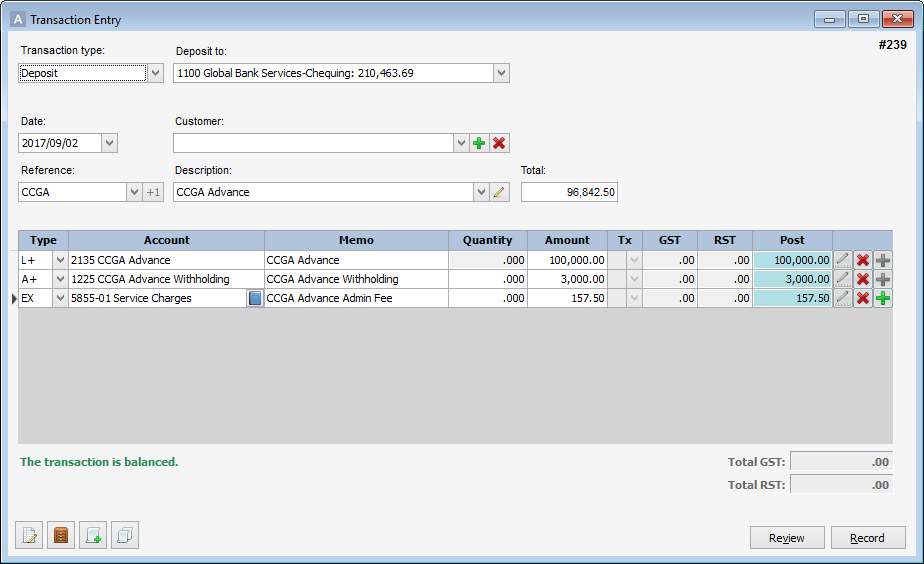

You’ll need to enter a deposit in AgExpert Analyst when you receive a CCGA advance. You’ll need to split the transaction between several items to make sure the loan amount, withholding and any applicable fees are dealt with.

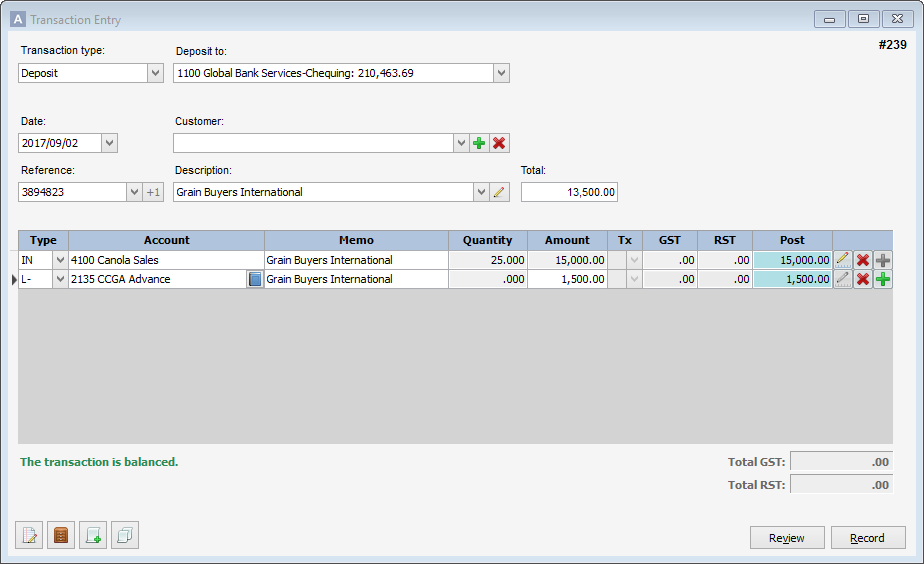

CCGA payments are typically deducted from your sales tickets. To make sure the balance of your CCGA advance remains up-to-date, you need to record the payments as they’re made.

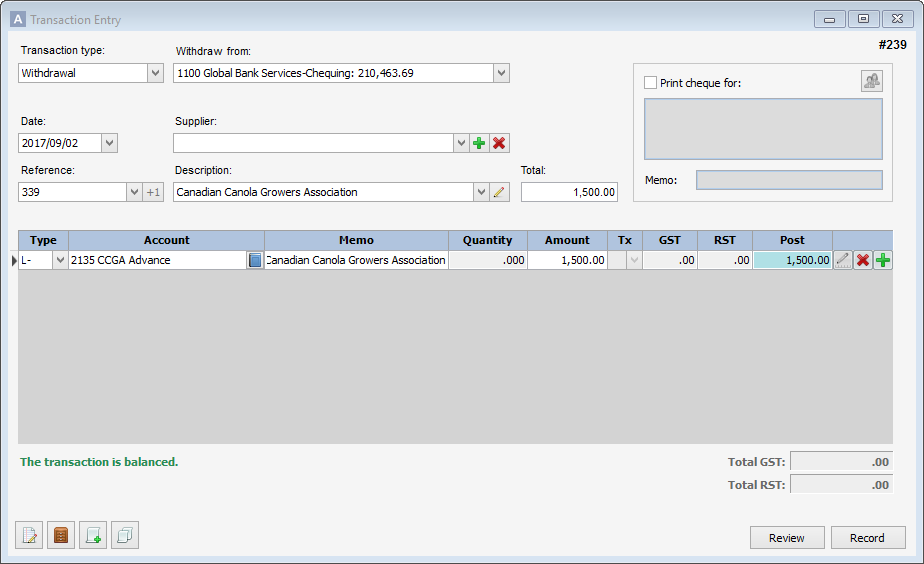

If you cut a cheque to assist paying some of the advance back, treat the cheque as if it’s a regular loan payment.

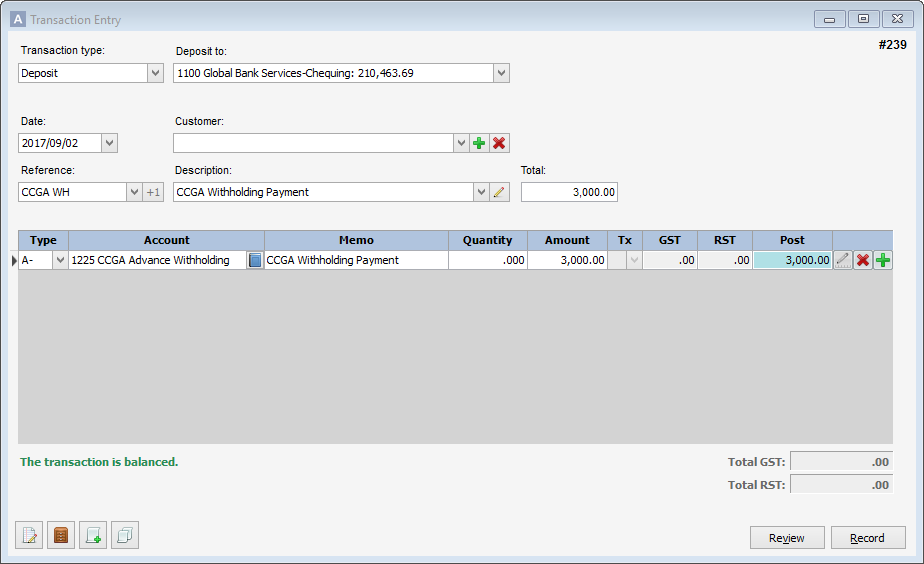

Once the loan is paid off, the withholding amount will be returned to you. Apply this payment against the asset you set up when you first received the advance.

Last updated on September 20, 2017 by FCC AgExpert