Year End > Year End > Preparing for year end

Before the fiscal year end there are some steps that must be taken before bringing your books to the accountant.

- Ensure that all financial records are included. Reconciling the following accounts to year end will ensure you have entered all financial activity for the fiscal year:

- All bank accounts (including credit cards)

- Loan balances

- Accounts receivable

- Accounts payable

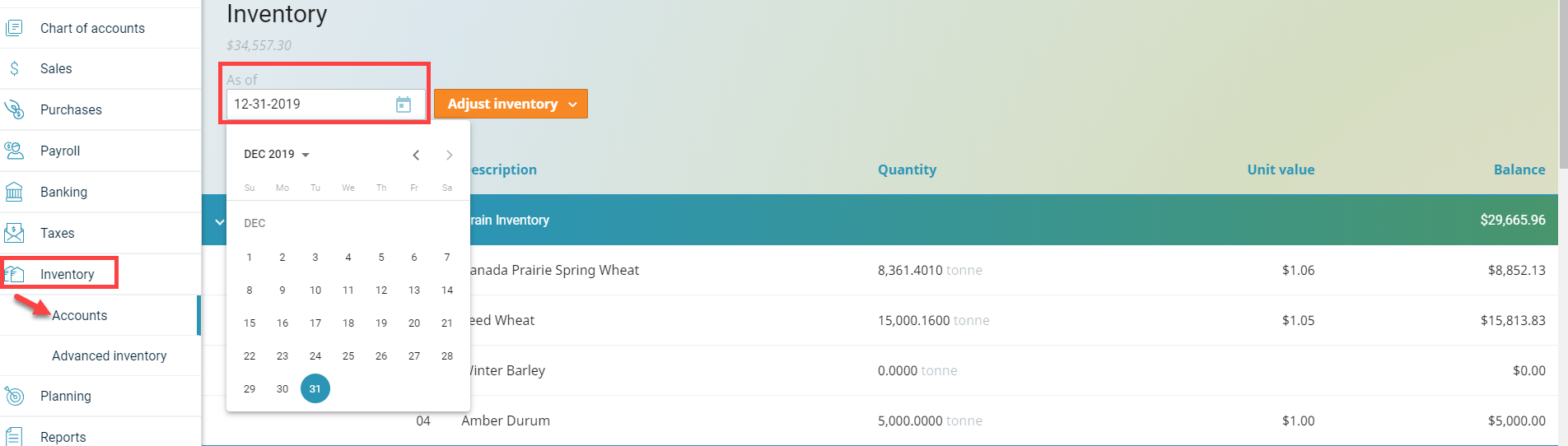

- Review your inventory, both quantity and unit value, to ensure accuracy. Go to Inventory > Accounts and enter the last day of your fiscal year into the As of box.

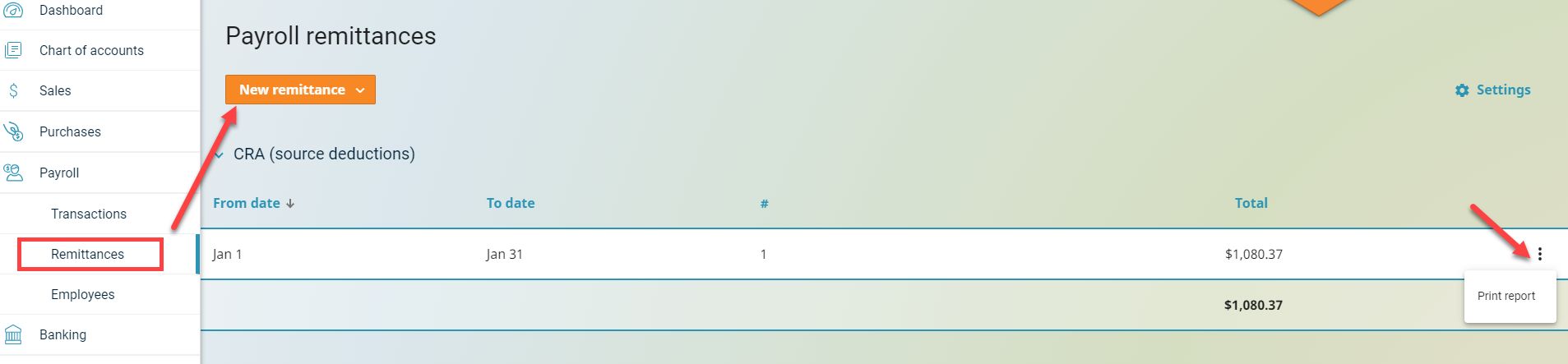

- Review payroll records.

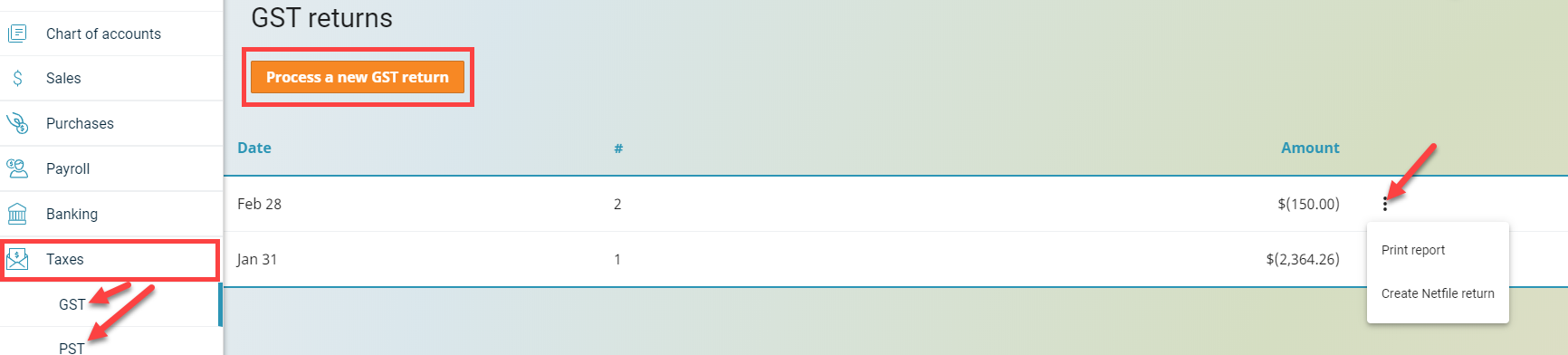

- Process the final GST/HST report and PST report (if applicable).

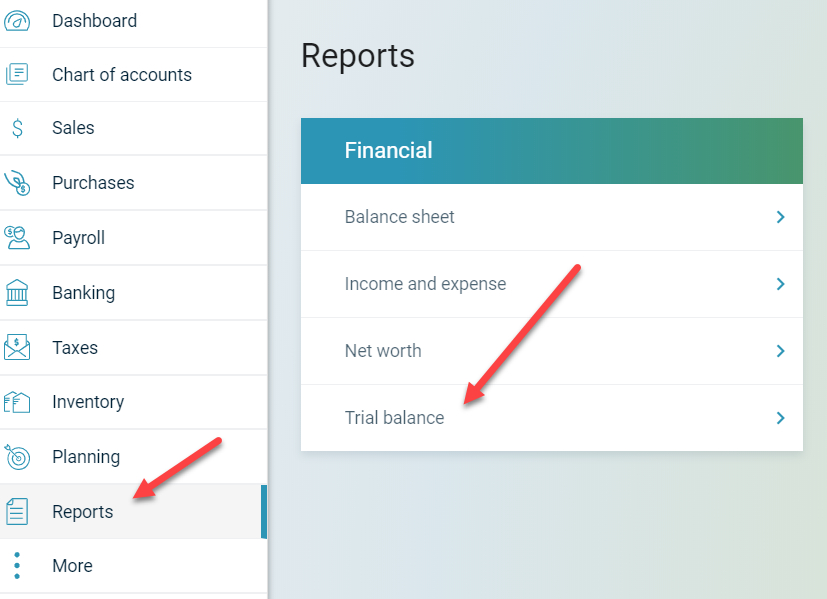

- Print a Trial Balance report to review that account totals are accurate.

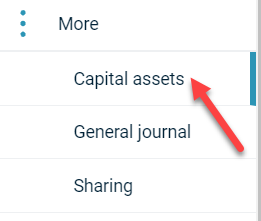

- Verify your capital assets. Select More and Capital Assets.

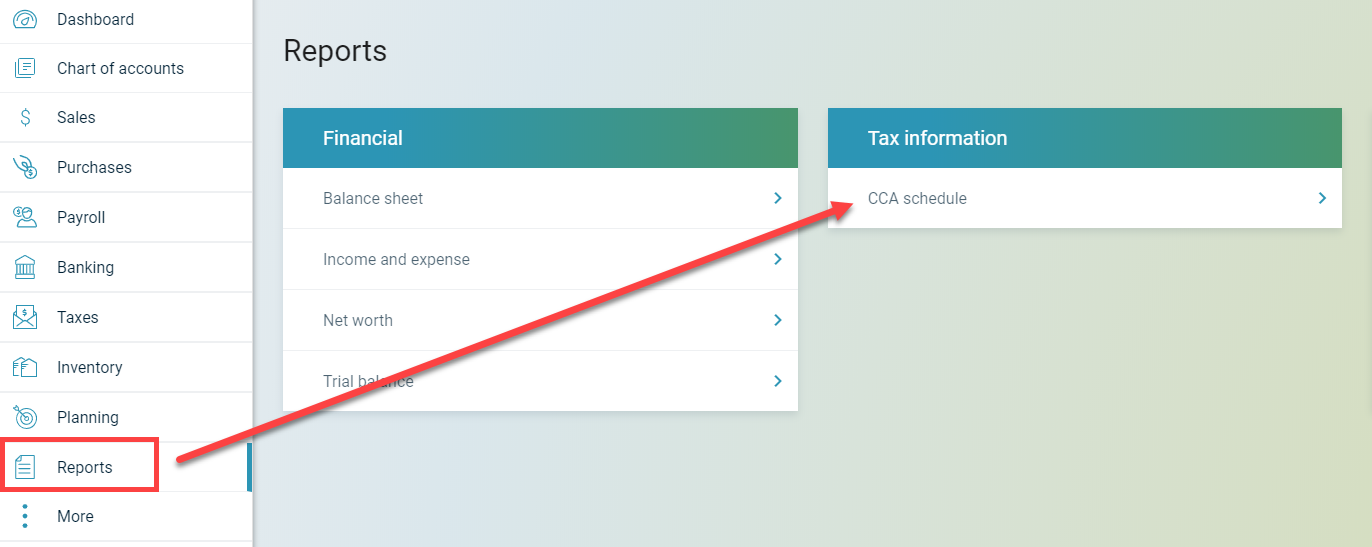

- Review your CCA schedule report. Go to Report > CCA Schedule.

Items to take to your accountant

With a Premium Subscription you share your file with your accountant. They will have access to everything they need to complete your year end. To share go to More > Sharing > Share access with...

If your accountant does not have AgExpert Accounting, provide them with the following reports:

- A cash-based Income/Expense report for income tax reporting purposes

- A General Ledger report to support the Income/Expense report numbers

- An accrual-based Income/Expense report for financial statement purposes

- Account Receivable and Accounts Payable reports

- An Advanced inventory report. Go to Inventory > Advanced inventory

- List of Capital assets (to print this screen on a Mac select Command + P; on a Windows computer select Ctrl + P)

- A Trial Balance report

Make sure the following source documents are readily available:

- Year-end bank and credit card statements

- Year-end payable statements

- Year-end loan statements

- Capital asset purchases and sales receipts

- All sales tickets

- Any other documents that support year-end balances (equity statements, AgriInvest statements, etc.)

Last updated on July 28, 2020 by FCC AgExpert