Are you ready for your financial year-end?

The Canada Revenue Agency deadline for filing your income tax is April 30, which is right around the corner. Make your life – and your accountant’s – easier with AgExpert Analyst, and make sure you’re ready to file.

Go at your own pace

You can move into the new year when you’re ready. AgExpert Analyst has a perpetual database system and no actual Year-End button. Does your accountant work in AgExpert Analyst at year-end? Easy. Use the Accountant’s Copy feature to send your data to your accountant so that they can work on the old year while you work in the new year. When they’re finished, you can import their changes into your working copy to update your balances appropriately. How do you enter the accountant’s adjustments manually? Also easy. Here are a few things to remember:

- You can adjust inventory value and quantity, but the math must match. Debits must have positive quantities, credits must have negative quantities.

- You can adjust value using Debit or Credit and leave the Quantity as zero (new in 2017). This rule is true only if the account is not at zero prior to, or after the adjustment is recorded. (See the next two points).

- If inventory is currently at zero and you’re debiting to increase inventory, you must put a quantity on that line. You may not know what the correct quantity is, so make your best guess based on what you think the value per unit might be. The logic: you can’t have a positive value if there’s nothing on hand.

- If zeroing out the inventory, you must zero out the quantity as well. If there are 3 units of inventory valued at $300 and you want to credit (-) the inventory account by $300, then you’ll need enter negative 3 as the quantity on that line.

- You can only back out what is currently on hand. For example, at year-end, there are 3 units of inventory valued at $300 if you did a bit of work in the new year before sending your books to your accountant and sold 2 of those inventory units so “current” inventory is 1 valued at $100. In that case, you can’t back out $300 at year-end because that would make “current” inventory a negative $200. The easiest solution is to enter $200 worth of inventory on to the account in the new year to give you the room required to remove $300 in the old year.

- To enter adjustments against AR Customers or A/P Suppliers, use the regular transaction entry window to create a Receivable Charge (1200-00) or Payable Charge (2100-00).

How to: Create your accountant’s copy

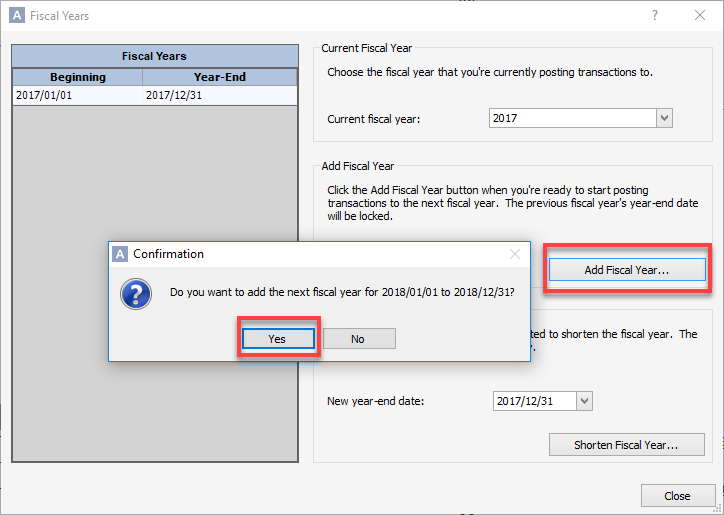

- Add your next fiscal year so that you can continue working in your books. Go to Setup and Fiscal Years. Click Add Fiscal Year.

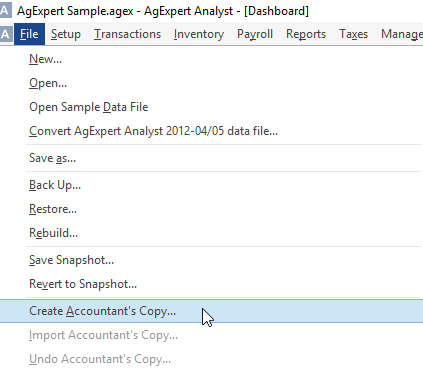

- Close the Fiscal Years window and go to File and Create Accountant’s Copy.

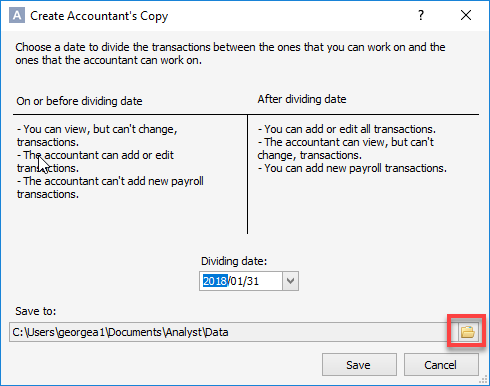

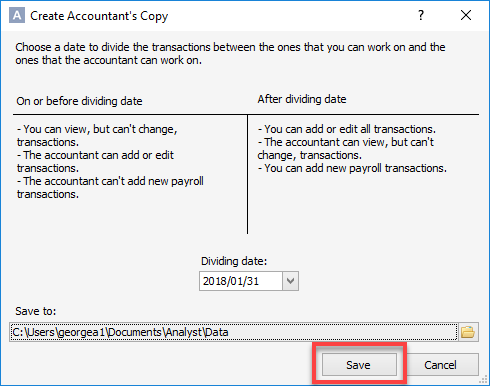

- Set the dividing date as the last day of your fiscal year. You can view anything before the dividing date, but cannot edit. Your accountant will have access to everything before that dividing date to work on your year-end. You can continue your books after the dividing and your accountant can view the data but cannot make any changes.

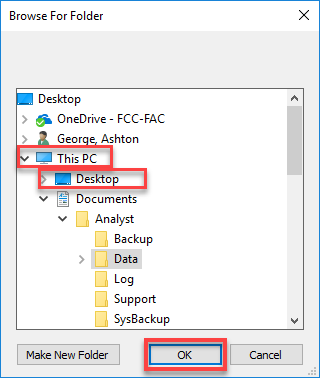

- Select the save location for your Accountant’s Copy. Click on the yellow folder in step 3. Save it to the desktop so that it’s easy to attach to an email. You’ll either see “this PC” or “computer.” Click whichever one you see, then click on Desktop and Data. Click OK and save.

- You'll see this icon on your desktop with the extension .agacctransfer to send to your accountant.

Year-End tips in AgExpert Analyst

- If year-end has your head spinning, check out this handy list of 9 tasks to wrap up your fiscal year.

- A file with the extension .agacctransfer goes to your accountant. The file extension .agextransfer comes back from your accountant once the entries are complete.

- Top Tip 1 Do not undo the Accountant’s Copy. If it’s undone, you won’t be able to import the data your accountant sends back to you.

- If your accountant doesn’t have AgExpert Analyst, you can print or export the required reports.

- Top Tip 2 Always add your next fiscal year before creating the Accountant’s Copy.

Thursday, March 22, 2018 at 8:26AM

Thursday, March 22, 2018 at 8:26AM

Reader Comments