Payroll > Setup > Setting up Custom Deductions

Setting up Custom Deductions

You can set up any custom payroll deductions you need to in the payroll module of AgExpert Accounting. You do not need to set up any of the standard source deductions, as these are set up for you by default.

On the left navigation bar, click Payroll, then click Employees.

Click on the employee that you want to add a new custom deduction for. Scroll down to Deductions and click Add.

Click Add new deduction.

Give the new deduction a name. If there is a maximum contribution for this deduction, enter it. If there is no maximum, leave the field blank.

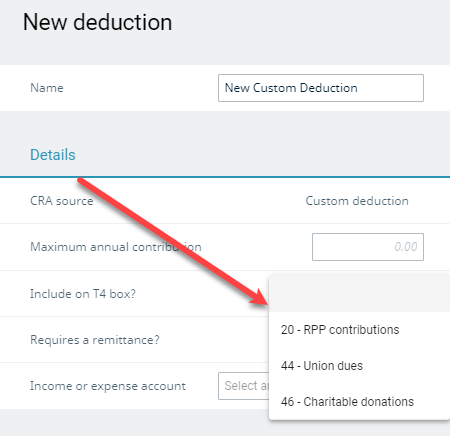

If the custom deduction is for RPP contributions, Union dues, or Charitable donations, select the appropriate T4 box.

If you are required to remit this amount to a third party (such as an insurance company, or government agency), move the slider to the active position. This will change the options available below.

Click Add to add the remittance type. You can select an existing item from the list or add a new one if it is a new type of remittance. It is important to differentiate between your different deductions. An RPP deduction should not have the same remittance type as group insurance, for example.

Select the liability account that your deduction will post to.

The employer rate should be filled out if you remit a portion of the expense based on what the employee has deducted. For example, if you have a group insurance policy, it may be written that for every dollar deducted, the employer must remit 0.50. The employer rate in this case would be 0.5. If there is no expense to the employer, leave the rate blank.

If you do enter an employer rate, you must specify the expense account to record the employer’s portion.

If the deduction you are setting up does not require a remittance, all you need to enter is an income or expense account to record the deduction to.

Click Save when you are done setting up your new deduction. You can now assign the deduction to your employee.

Deductions are grouped between arm’s length and non-arm’s length employees. If the employee you set up a deduction is set as arm’s length, you will not be able to use the deduction on a non-arm’s length employee. Instead, you will have to set up a separate deduction for the non-arm’s length employee.

If you need to update any information for your custom deductions, you can do so from the employee landing page by clicking Settings.

This will open the Employee settings screen. Click Deductions.

Click the custom deduction you created.

You can now edit any information you need to and save the deduction when complete.

Last updated on July 7, 2020 by FCC AgExpert