Transactions > Transaction examples - Capital Assets / Assets > Entering a capital asset built over time

Looking for something specific in the page and not quite sure where to find it? You can always press CTRL + F on your keyboard and type a keyword. Or you can do a search (in the top right corner).

Entering a capital asset built over time

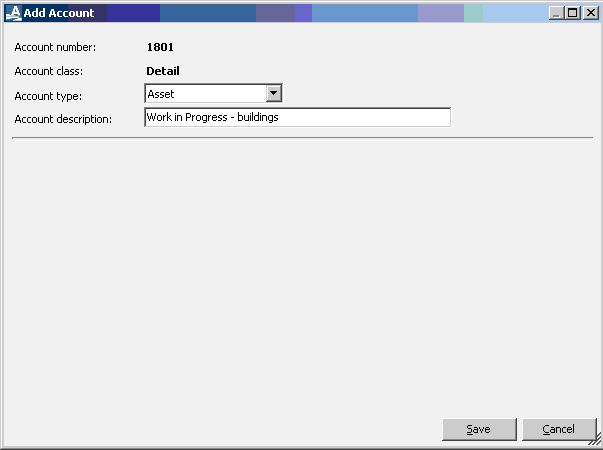

You can create a Work in Progress account for entering withdrawals allocated to an asset, such as a barn or a bin, being built over a period of time. Set up an account numbered 1801 and call it Work in Progress – buildings.

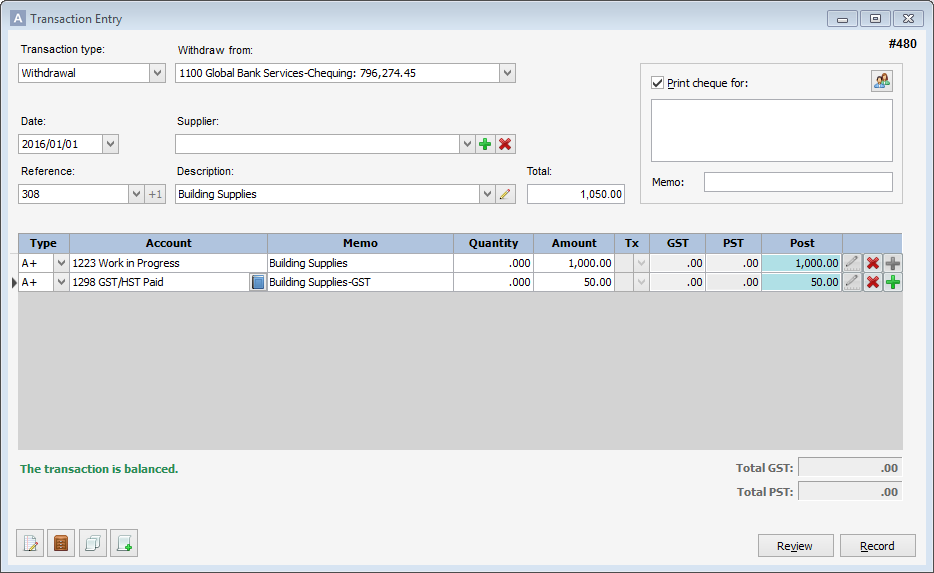

You'll receive bills as your build progresses. Every time you write a cheque, you can add it to the Work in Progress account. GST can be claimed on a second line.

Enter your cheques until the build is complete. Once you've made all the payments, take the full amount in the Work in Progress account and turn it into a single capital asset.

Last updated on August 31, 2016 by FCC AgExpert