Transactions > Transactions examples - Income > Claiming GST on a canary seed sale

Looking for something specific in the page and not quite sure where to find it? You can always press CTRL + F on your keyboard and type a keyword. Or you can do a search (in the top right corner).

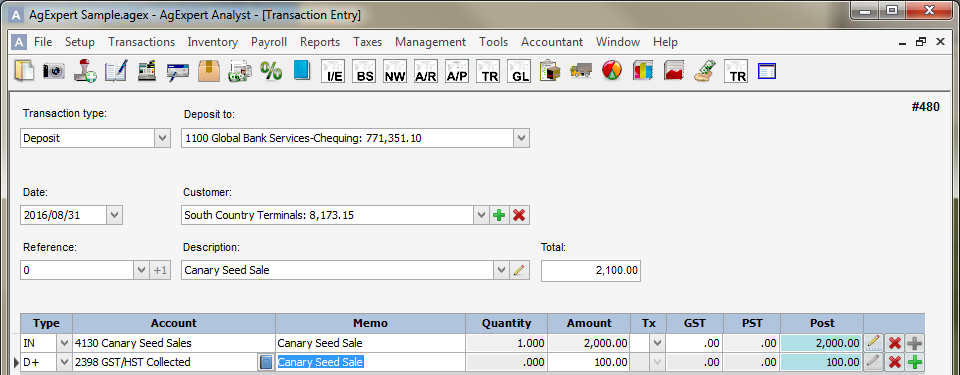

Claiming GST on a canary seed sale

GST is charged on canary seed sales likely because most canary seed is eventually sold as bird feed. GST charged on canary seed sales must be claimed as GST collected.

Enter a deposit to the respective bank account, an income line for the canary seed gross amount and a D+ Liability Addition to claim the GST collected on the sale.

Last updated on August 30, 2016 by FCC AgExpert