It's very practical... Capital Assets

Keeping good records of your capital assets is important and we recognize that there may be road blocks. You may feel like it takes too much time or maybe that it’s too complicated and you aren’t quite sure how to do it. Some of the reasons why it’s worth the extra effort are:

- Quickly generate a list of current capital assets for insurance purposes, and maintain a list of historical capital assets as part of your financial records.

- Calculate and post your capital cost allowance.

- Calculate depreciation for management reporting using five different methods.

- Ensure your Net Worth Report is accurate.

- Automating your capital asset records helps to keep you organized and efficient.

What does it look like?

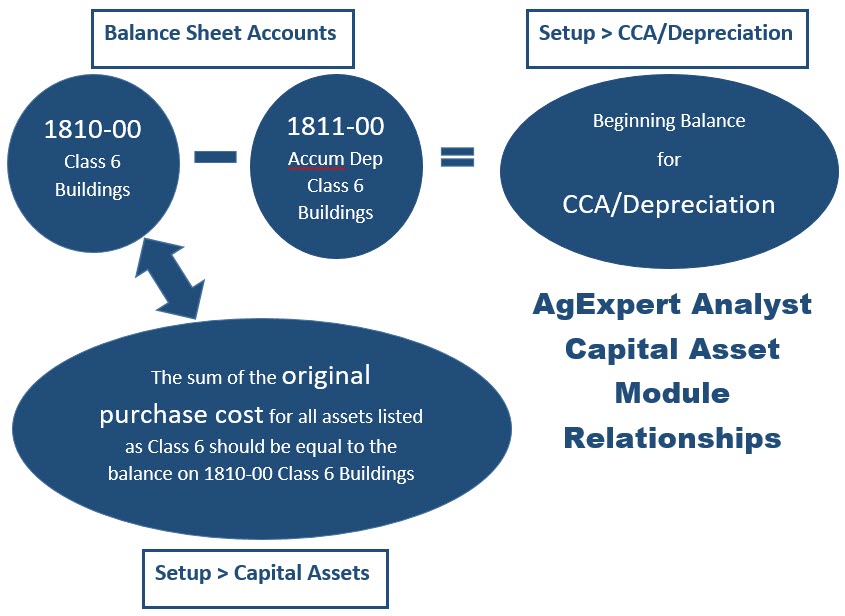

Capital assets are tracked in four ways in AgExpert Analyst.

- The Balance Sheet tracks your assets by class and reports the total for each class as well as the accumulated depreciation in separate accounts.

- The Capital Asset listing (Setup > Capital Assets) tracks the details of each asset individually.

- The CCA/Depreciation module allows you to calculate your capital cost allowance for tax purposes.

- The Net Worth report allows you to track the Fair Market Value for each asset over time.

The info-graphic and story below demonstrate how AgExpert Analyst ties the first three together.

Let’s walk through a real life example. Jane just bought a new grain bin for $30,000 and enters it into AgExpert Analyst. The program will increase account 1820-00 by $30,000 and record the serial number, purchase date and original cost to her capital asset listing. Also, her CCA Schedule will update to reflect the $30,000 addition and forecast the depreciation using the half-rate rule.

The fourth way, tracking Fair Market Value (FMV), allows you to easily generate an accurate Net Worth report. Check out the video below to learn more about Fair Market Value with Steven Tippe from the FCC Customer Care Team.

Practically Speaking

Let’s walk through a few transactions dealing with capital assets and some scenarios you're likely to encounter.

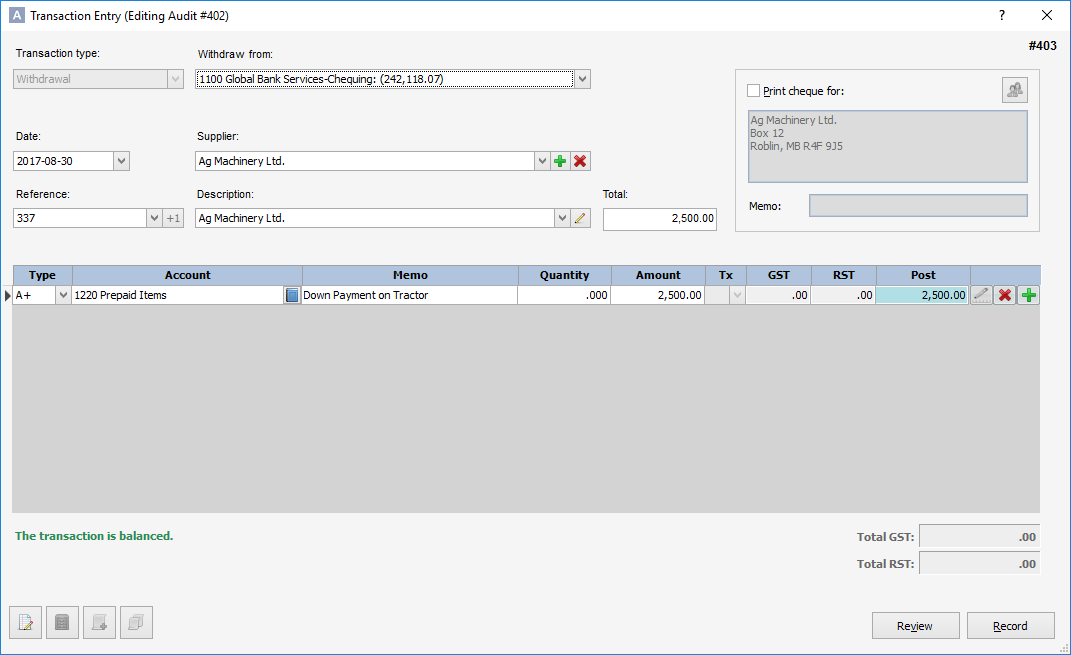

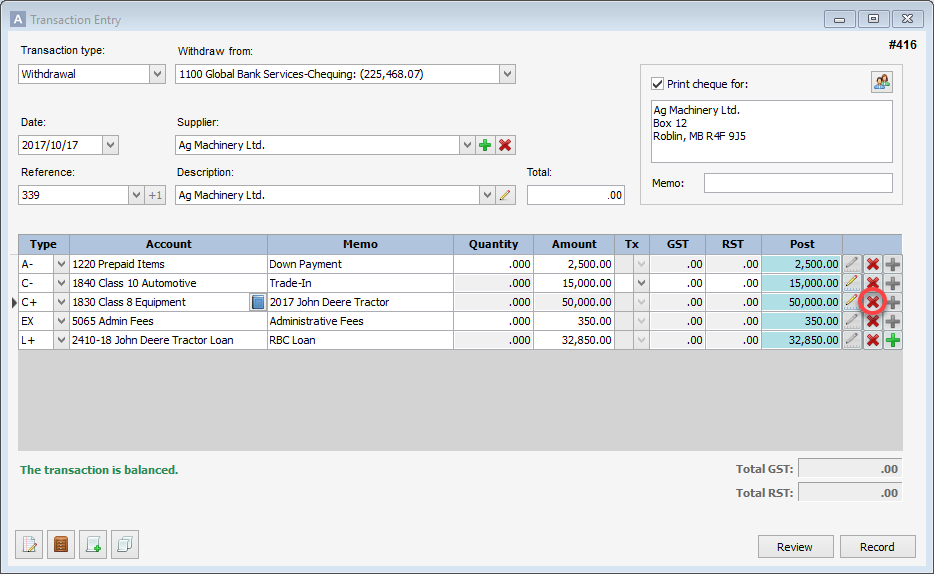

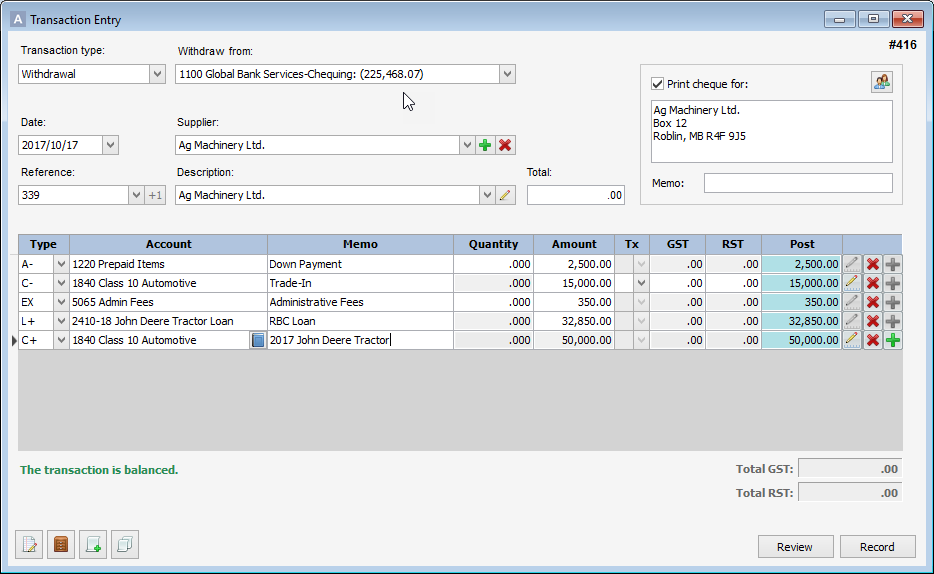

- You finance a new capital asset purchase (tractor) and trade in an old one. You also put a deposit on the purchase at an earlier date. First, we need to enter the deposit.

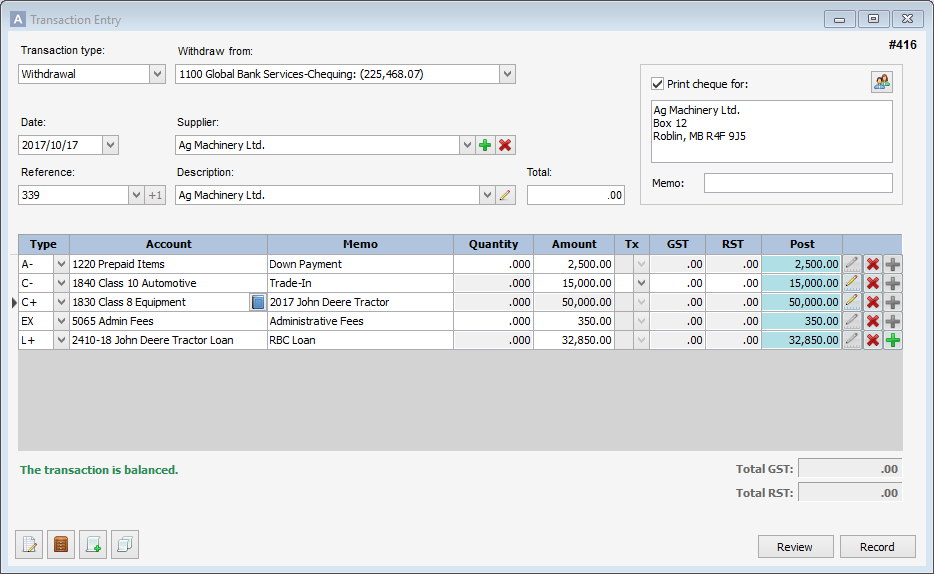

Once that's taken care of, we can enter the 2nd payment and take care of the capital asset purchase.

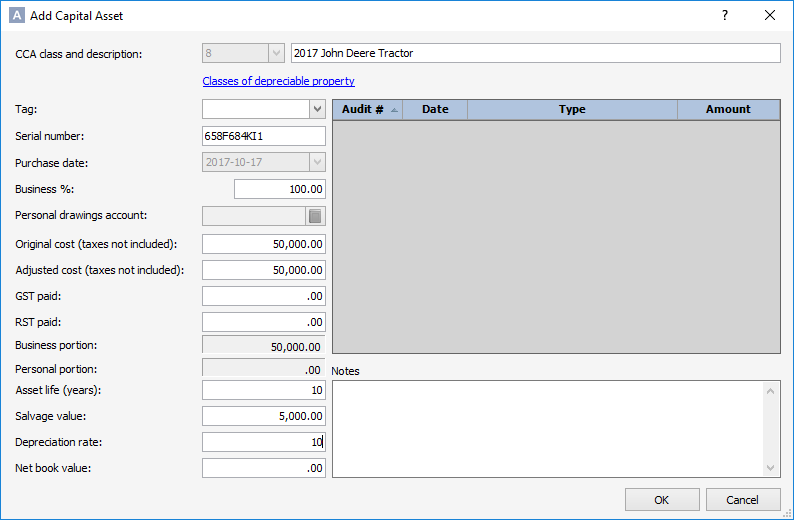

When you’re entering a C+ line, AgExpert Analyst gives you a supplemental window where you

can enter the details of the capital asset. (Pro tip: if you accidentally close this window, just

click on the at the end of the C+ row to get the window back.

at the end of the C+ row to get the window back.

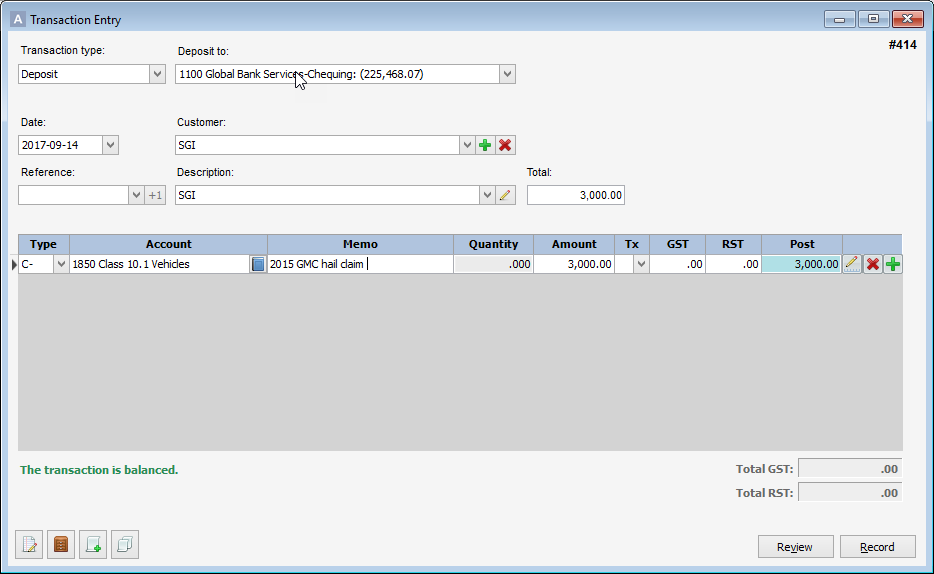

- A hail storm damages your truck so extensively that the insurance company decides to write it off. When you receive the cheque, you enter a deposit (not a withdrawal) into AgExpert Analyst.

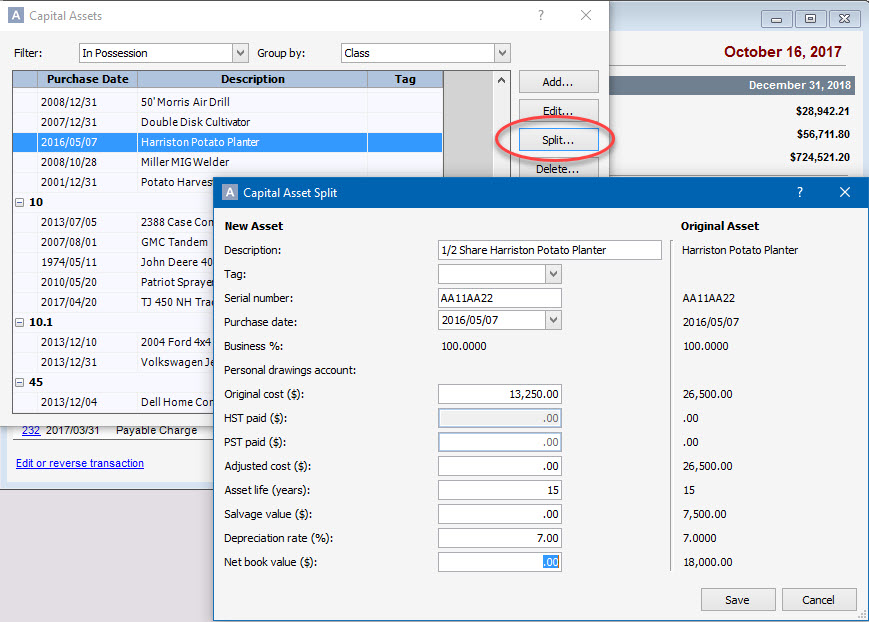

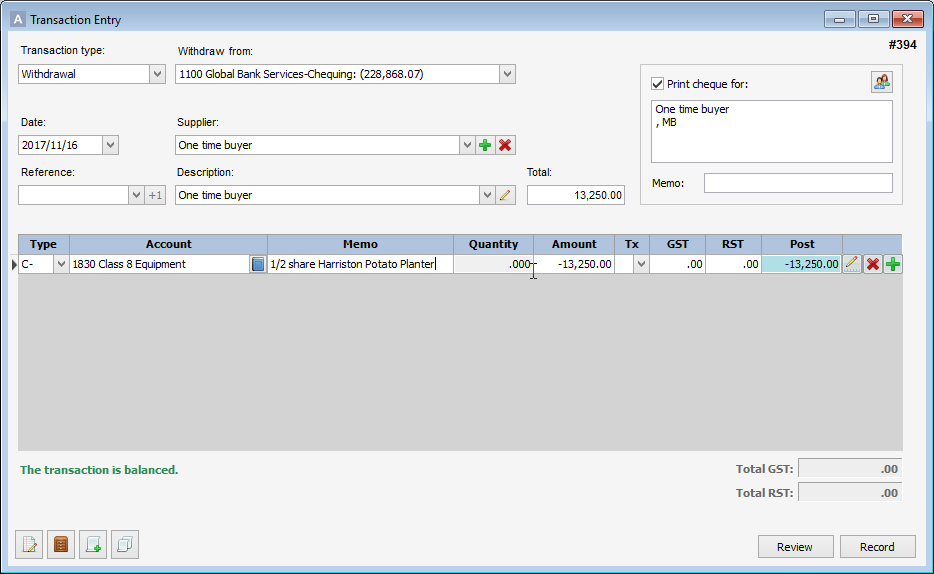

- You sell a half-share of your potato planter to Jim. Before you can enter the capital asset sale, you need to split your capital asset in two.

Once you've got the capital asset split, you can then sell off the one you labelled as "1/2 Share."

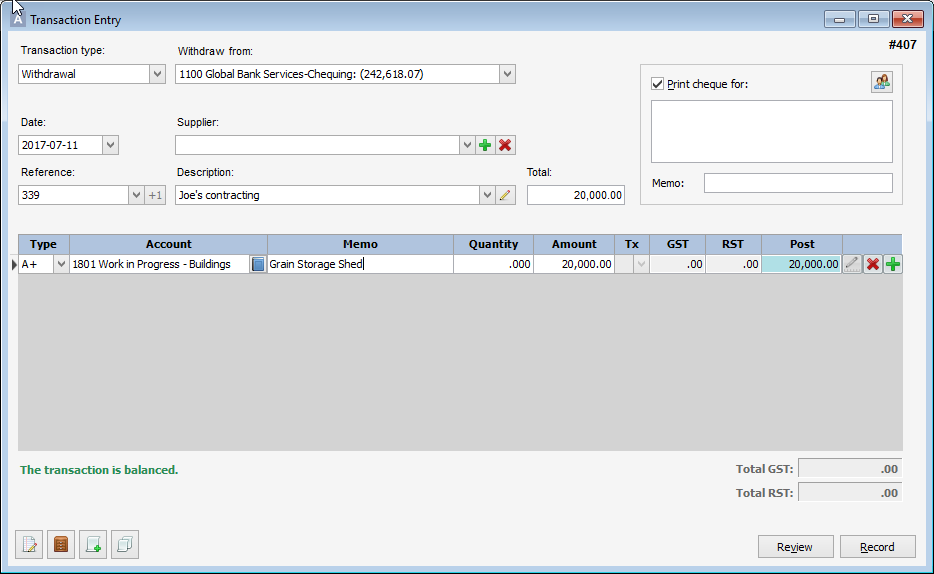

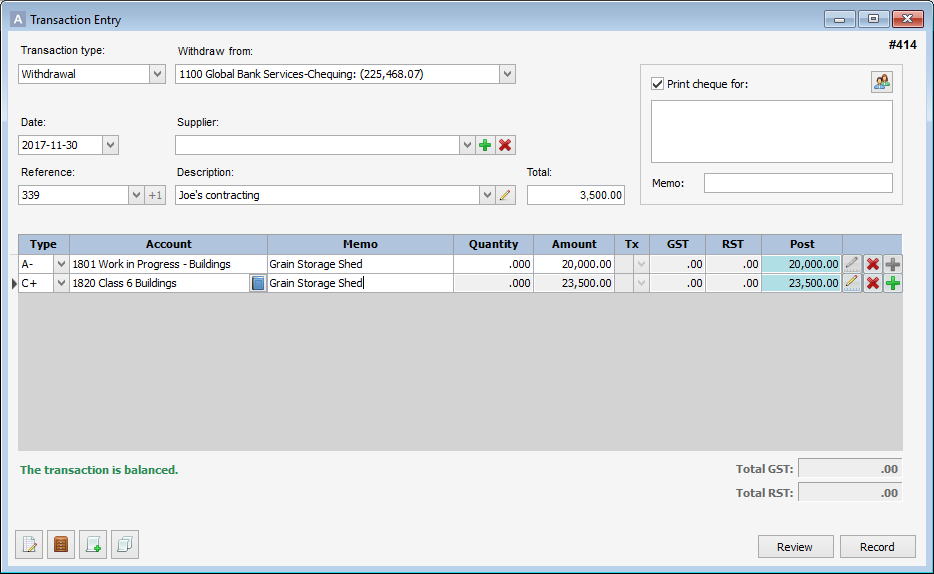

- When building a capital asset, you can place all expenses incurred throughout the project into a work in progress account to convert into a capital asset when the project is complete. This will be recorded with two separate transaction entries.

(If you know the GST, you can record that as a separate A+ line to the GST Paid account.)

When Joe’s Contracting issues their final invoice, all that’s left owing is $3,500.

- At year-end, the accountant reviews your books and informs you that the tractor you purchased and entered as class 8 should actually be class 10. To enter this into AgExpert Analyst, simply locate the original transaction, click on Full Edit, delete the original C+ line and record a new C+ line to the correct capital asset account.

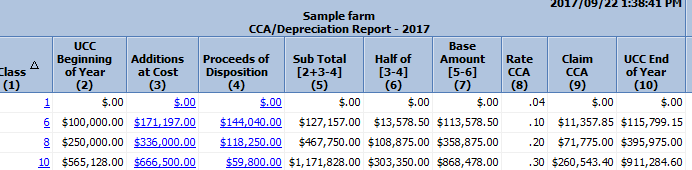

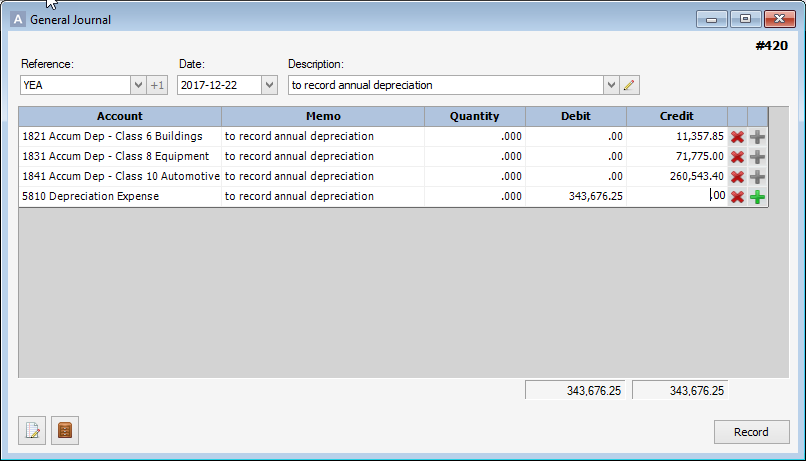

- Record year-end depreciation in the General Journal. You’ll find the numbers you need for this transaction in column 9 of the CCA/Depreciation report.

Best Practices

- All passenger vehicles are considered Class 10.1 rather than Class 10. This means that the maximum claimable GST on the purchase is $1,500. Any remaining GST should be included in the Original Cost field of the Add Capital Asset window.

- Top Tip - Every time you add a new fiscal year or you receive your tax package back from the accountant, set the beginning balance for the year in the CCA/Depreciation window.

- When reviewing your Income and Expense report as you approach year-end, set the Depreciation to either User or Maximum to include a depreciation expense forecast on the report. This will give you an idea of what your real bottom line will look like.

- Review and set new FMV amounts at least once per year to ensure that your Net Worth statement is relatively current. And it never hurts to update it more frequently too.

Monday, October 16, 2017 at 1:32PM

Monday, October 16, 2017 at 1:32PM

Reader Comments