Make AgExpert Accounting work for you with easy Payroll features

Payroll tax forms and filing season is nearly here.

It’s fast and easy with AgExpert Accounting. Generate payroll tax forms for your employees and for filing with the Canada Revenue Agency using the following steps.

1. Setting up employees

Creating the profiles for your employees is the first step in using the Payroll features. If you have already done that, move on to step 2. If not, you can get started with the instructions for Setting up Employee Profiles.

2. Running payroll

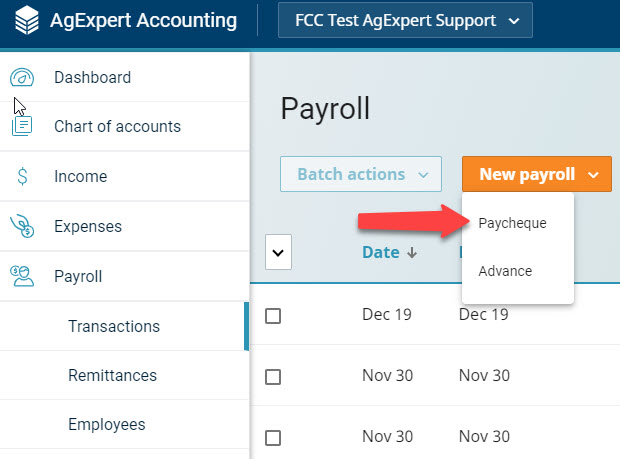

Create paycheques or advances through the payroll menu by selecting New payroll.

3. Printing paycheques

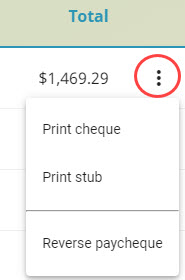

To print paycheques or paystubs that have been created, click on the three dots to the right of the payroll transaction.

4. Generating tax forms and filing with CRA

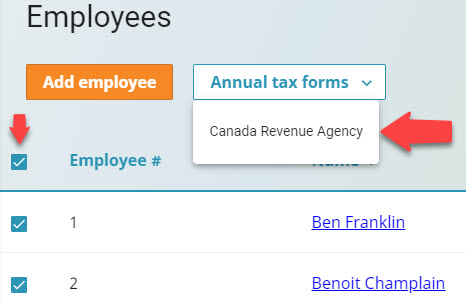

To generate tax forms, T4 and RL-1 (Quebec), open the Employees landing page. Select the employees you wish to generate the documents for, and then click Annual tax forms > Canada Revenue Agency.

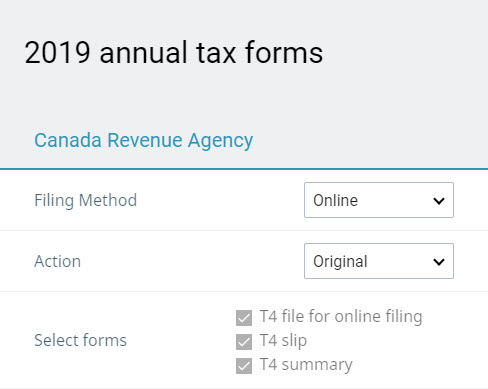

You have the option for paper and online filing. AgExpert Accounting provides you the files you need to give to your employees, and for reporting to Canada Revenue.

Monday, January 13, 2020 at 8:44AM

Monday, January 13, 2020 at 8:44AM

Reader Comments