Tuesday

Dec052017

It's very practical... Cash Flow

It’s easy to know how much cash you have on hand today. Just open the banking app on your phone – and there it is. What it won’t do is show you how much cash you’re going to have in the future. The cash flow module in AgExpert Analyst allows you to do just that. When funds are tight, this tool can help you walk that tight rope successfully. Will you have enough on hand in March to make that loan payment? With the cash flow module, you can rest easy knowing that you’ve got it covered.

What does it look like?

A basic cash flow report is easy to create.

- The Cash Flow module takes your starting cash position, then helps you forecast future inflows and outflows.

- You can set it up based on numbers that already exist – then tweak the forecast to make it even more accurate.

- To keep it simple, AgExpert Analyst uses the indirect method for cash flow statements.

Practically Speaking

Let’s look at how to set up cash flow and what you can do.

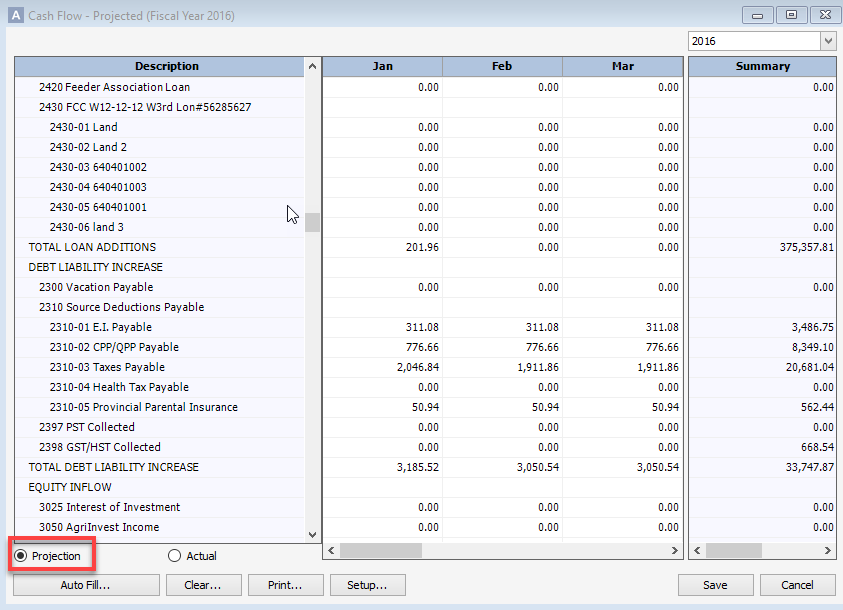

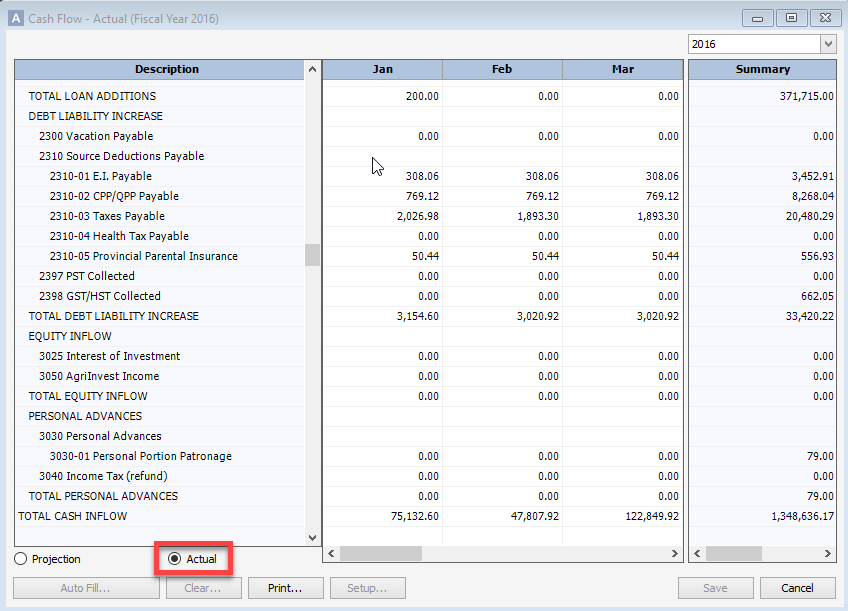

- Projection vs Actual

Projection allows you to manually manipulate your cash flow. You can edit fields to predict what you

should expect to be your cash inflows and outflows over a period of time (monthly, quarterly, yearly).

Actual will show you exactly what you have today based on real life transactions that have been recorded in AgExpert Analyst. When producing an actual cash flow statement, you cannot edit any field.

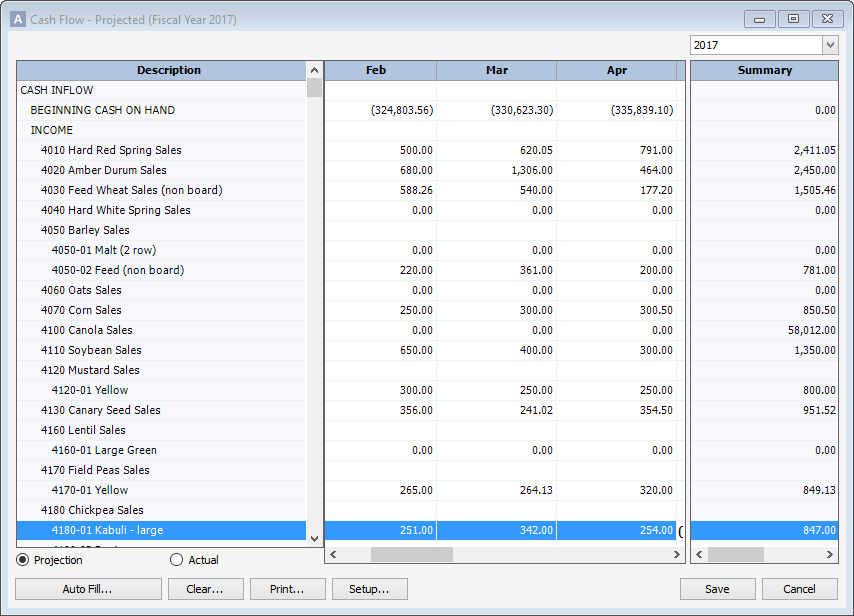

- To set up your projections, collect information about your transactions from previous years. Account for factors that could change each year: price fluctuations, environmental conditions, or inflation. Once you have gathered information from past years, you can begin to complete your monthly projections.

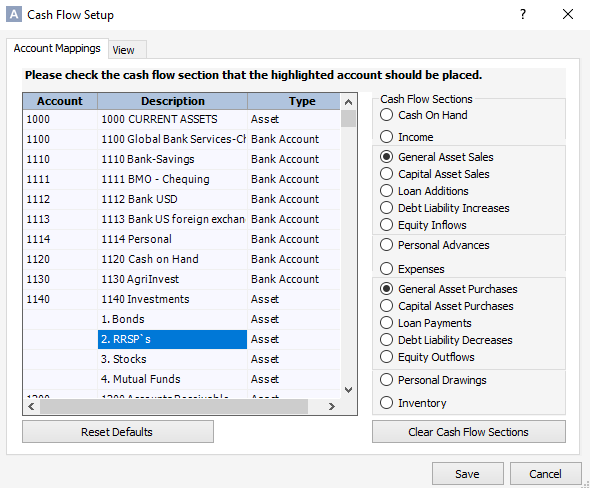

- In the Setup menu, ensure that all your listed accounts are linked to cash flow sections. If you don’t like how your accounts are linked, simply highlight the account, and select the cash flow section you want it to report to and click Save.

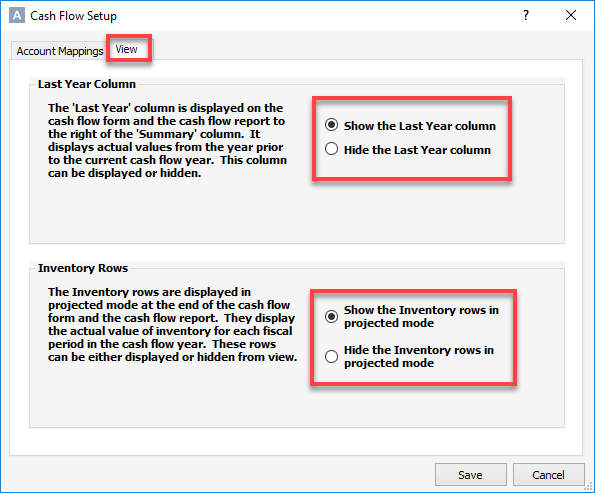

- In the View tab you can decide if you wish to include last year’s numbers and current inventory. Keep in mind that inventory balances are for projection purposes only and will not show on an actual cash flow report.

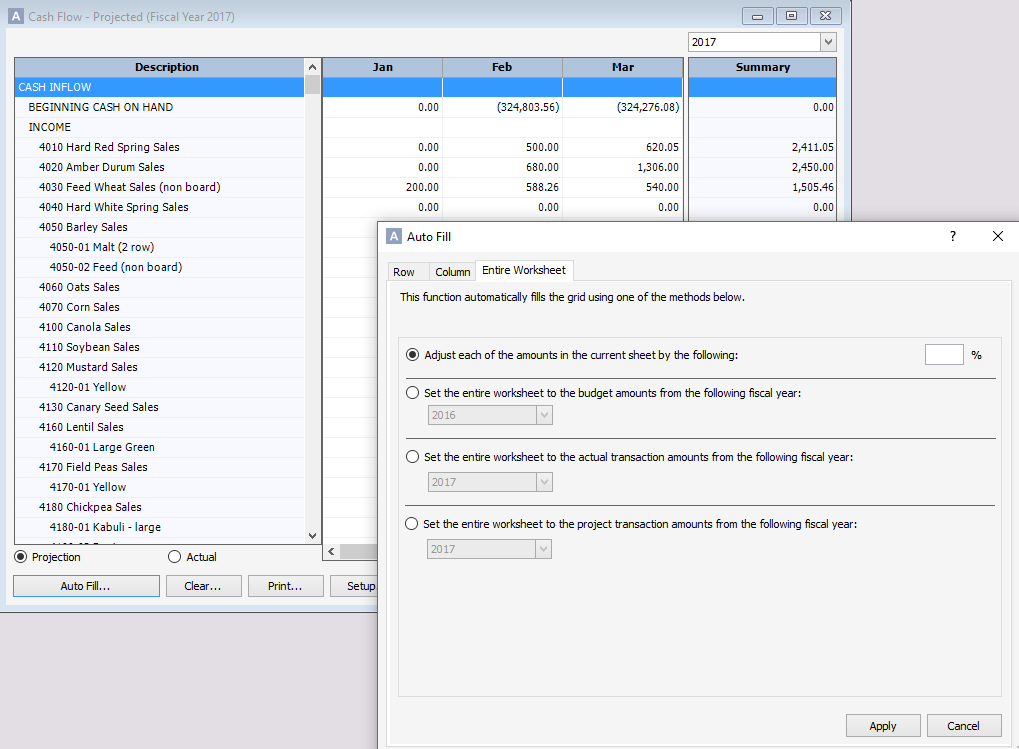

- The Auto fill option is a way to either automatically fill a row, a column, or the entire worksheet. This option is only available for a projected cash flow because the actual will pull from your transaction entries. We like to start by auto filling the entire worksheet.

Best Practices

- Don’t confuse budget with cash flow. A budget is aspirational – it’s what you hope is going to happen. Cash flow is reality – it’s the biography of how money moves in and out of your account.

- Review your cash flow periodically to make sure your projections are on track.

- Top Tip: To keep your cash flow statement accurate, reconcile your bank regularly.

- If cash on hand seems to be particularly high and the funds are not required in the immediate future, it may be appropriate to consider making some short-term investments.

Posted on  Tuesday, December 5, 2017 at 1:55PM

Tuesday, December 5, 2017 at 1:55PM

Tuesday, December 5, 2017 at 1:55PM

Tuesday, December 5, 2017 at 1:55PM

Reader Comments