Record your deferred grain tickets with AgExpert Accounting

Published November 2020

We all love receiving income, don’t we? It’s up to you how to account for it. Do you choose the accrual or cash method? You can use either method, but not a combination of both.

With accrual, the basic rule to follow is “the revenue recognition principle.” It stipulates that revenue is recognized when you earn it, not when you receive it.

If you follow the accrual accounting method, you report all cash and credit transactions. Once you sell a good or service to your customer, the revenue is considered earned already and should be recorded. Similarly, when you purchase a good or service, the expense is considered incurred, whether or not the payment has been made.

You can record your deferred sale in AgExpert Accounting in just two steps.

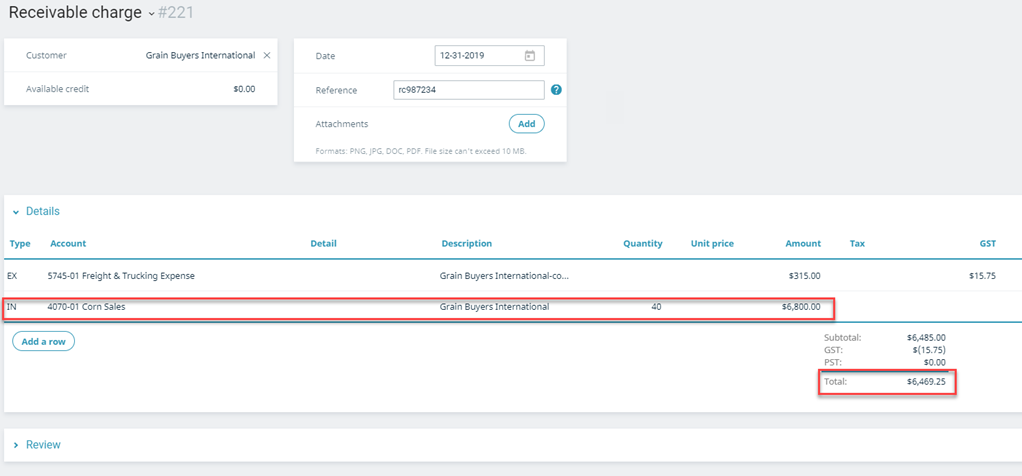

Let’s assume you hauled 40 tonnes of wheat being sold to Grain Buyers International for $6,800 less freight and trucking fees, so you’re expecting a cheque for $6469.25.

1. Record the income to be received

Click the plus sign (+) in the orange banner at the top right of your screen and select Receivable charge.

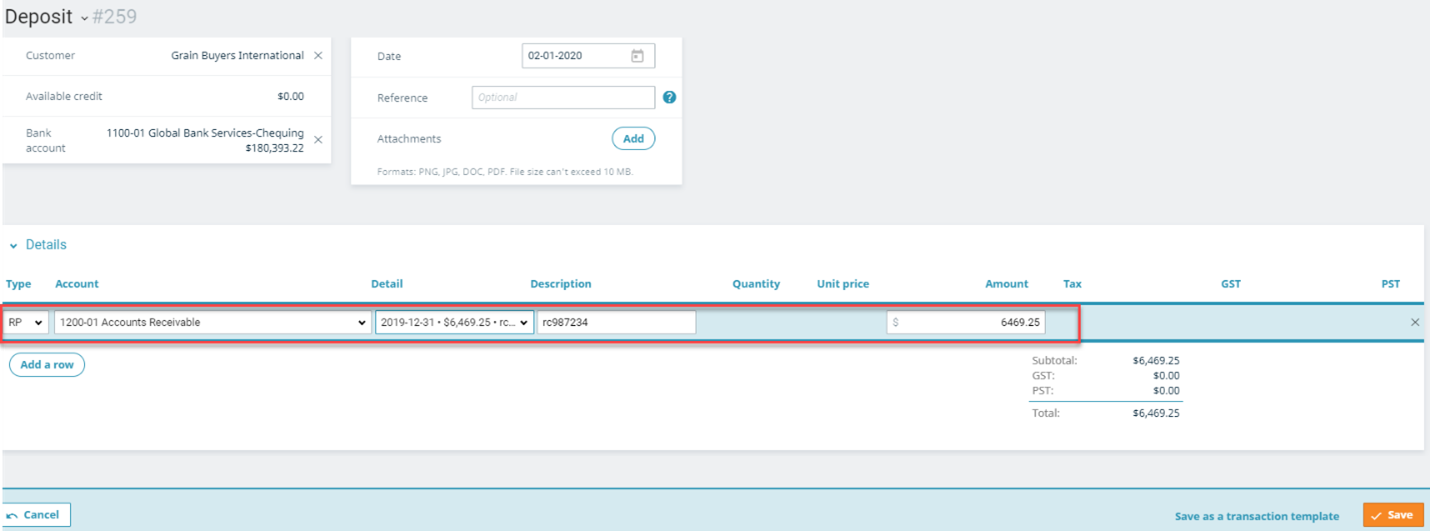

2. Record the payment when it’s received

Click the plus sign (+) in the orange banner at the top right of your screen and select Deposit. Select RP (Receivable Payment) as your account type and apply your payment to the receivable recorded earlier.

For more details on how to record a receivable payment, visit the AgExpert Online Community page: http://community.fccsoftware.ca/transactions-aa/transactions-examples/working-with-receivables.html

Thursday, October 22, 2020 at 3:38PM

Thursday, October 22, 2020 at 3:38PM

Reader Comments